From a market perspective, the last few weeks have been something of a rollercoaster. In the middle of March, both the Dow Jones and the FTSE 100 suffered their biggest one-day falls since 1987 as the markets tumbled.

Then, in the week before Easter, the Dow Jones experienced its biggest single week rise since 1974.

Trying to pick the bottom of the market is all but impossible. And, with the pandemic set to be a feature in the economy for the rest of 2020 and beyond, it’s hard to predict how and when markets might recover in the short or even medium term.

However, turmoil in the markets doesn’t mean you should refrain from investing. As the old saying goes, it’s “time in the markets, not timing the markets” that is important.

Missing days in the market could cost you dearly

In times of market volatility, investors commonly react by pulling their money out of the market. You may decide that retreating from equities is the best course of action.

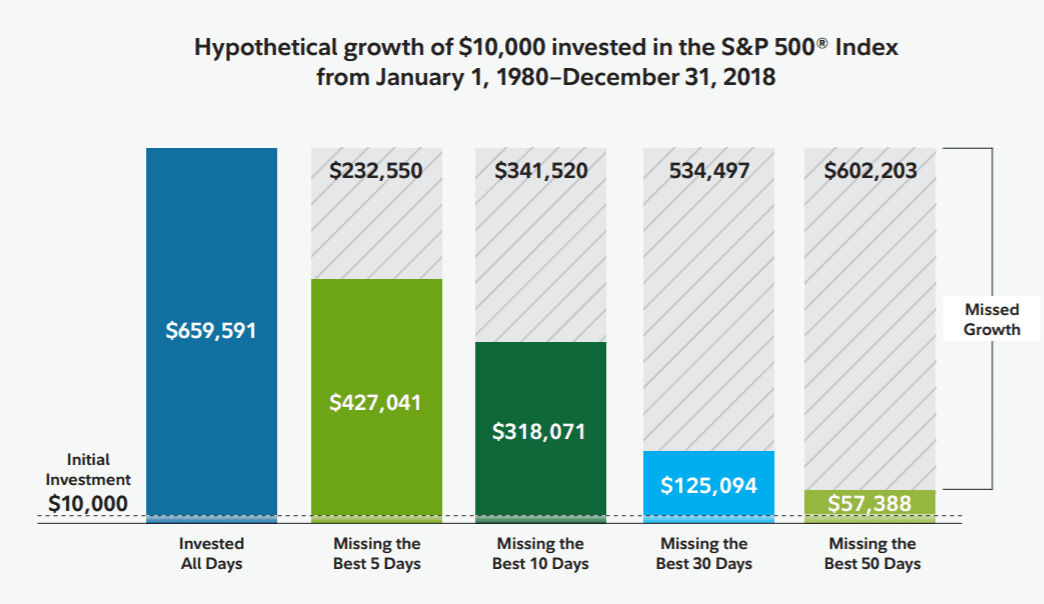

However, as the example below shows, if you do react by pulling your money out — even for a short time — you could miss out on potential long-term growth.

Source: Fidelity

Fidelity looked at how $10,000 would have grown had you invested it in the S&P 500 Index from the start of 1980 to the end of 2018.

- If you had left your $10,000 invested throughout that entire period, it would have been worth $659,591 on 31st December 2018.

- If you had pulled your money out of the market and you had missed just the best five days in the market during that 38-year period, your total investment would be worth $427,041. You would have sacrificed $232,550 (more than £194,000) simply by being out of the market for five days.

- If you had missed the best 30 days between 1980 and 2018, your $10,000 investment would be worth just $125,094 on 31st December 2018. You would have sacrificed $534,497 (around £429,500) of gains by being out of the market for just 30 days.

This data shows that trying to time when you enter and leave the market could have a significant impact on your returns.

How pound-cost averaging can help you take a long-term view

There are typically three options for an investor looking to commit money to the market:

- Invest it all immediately, and invest the rest as it is earned

- Save it up, and invest a larger sum all in one go when the market conditions are right

- Stagger it, and invest the money gradually over time

The third approach – investing a sum of money over a period of time, rather than all at once – is known as ‘pound-cost averaging’.

Imagine two investors each have £20,000 to invest.

Investor 1 decided to invest £10,000 each month for two months. In month one, £10,000 buys 200 units of a fund at £50 each. A month later the fund price has fallen to £40, allowing the investor’s next £10,000 investment to buy 250 units of the fund. This gives the investor 450 units of the fund in total.

Investor 2 decides to invest a lump sum of £20,000 in month one. They buy 400 units of the same fund.

If the fund value then increases to £60:

- Investor 1 has £27,000 (450 units x £60)

- Investor 2 has £24,000 (400 units x £60)

Pound-cost averaging can work well in a falling market for the reasons above. Of course, if markets start to recover then an investor will be worse off than if they had invested their entire lump sum in one go.

But, in a highly volatile market, it can allow investors to get back into the market by spreading some risk.

Get in touch

If you would benefit from investment advice in the current climate, we can help. Email info@henwoodcourt.co.uk or call 0121 313 1370.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.