If you’d like to download a copy of this guide, please click here.

Corporation Tax, VAT, National Insurance contributions, Stamp Duty, Capital Gains Tax, Income Tax, Dividend Tax… the list goes on.

As a business owner myself, and having worked closely with many successful business owners for over 20 years, the subject of tax arises frequently, and in particular they ask how they can extract money from their businesses tax-efficiently.

I particularly hear the moans and groans in January and July, when that brown envelope lands on our doorsteps and you can hear the shouts of “How much?”. Then, the vicious circle of tax is accelerated, when in order to pay the tax liability, you have to draw further money from your company, often in the form of a dividend, which incurs future tax liabilities as a result.

This guide is for owner-managers of successful companies, who are accumulating cash within their business, and provides a basic outline of the options available to withdraw monies. Within it, you will find new information that I personally find useful, and I hope you will do the same.

Understanding your options

Tax is complicated, and the methods I explore to extract cash from your business will not be right for everyone. As a financial planner working with successful, established business owners, I work hand in hand with specialist accountants in this field and know this is a constant topic of conversation with such clients to warrant the need for this briefing. You should discuss any of the options covered here with your trusted accountant, or get in touch with us. Ultimately, this briefing is for those who do not want or are not ready for a sale, but wish to draw remuneration from their business efficiently. Once you have read this guide, we’re here to help. Get in touch, and watch these videos to understand how we help business owners.

– NICK

1. Pay yourself a salary (PAYE)

We are all familiar with this one and I suspect most business owners will be doing this by taking a small salary. Why do we do this? The reason can be explained by looking at National Insurance contributions (NICs).

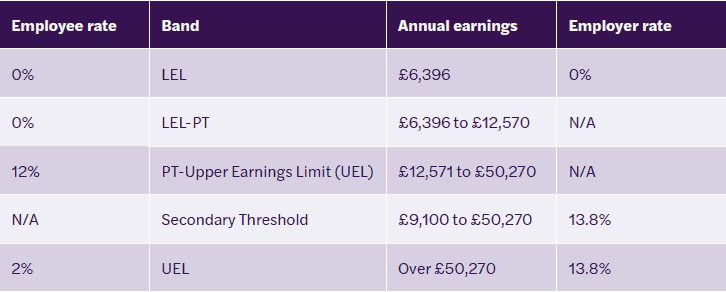

National insurance contributions (NICS) 2023/24

National Insurance (NI) is similar to income tax, but it helps to pay for some state benefits at times when individuals need help, for example, when unemployed or ill. Primarily, we pay NI so we gain credits towards our future State Pension.

NI is payable on earnings, and there are NI thresholds to be aware of. They’re all currently lower than the Personal Allowance and are important when setting your salary:

- The Lower Earnings Limit: providing your salary is above this level (£6,396), you’ll benefit from NI credits that count towards your State Pension and the main reason why you set your earnings at or above this level.

- The National Insurance (NI) Primary Threshold: as long as your salary is below this level (£12,570), you won’t need to pay any personal employee’s NICs.

- The National Insurance (NI) Secondary Threshold: as long as your salary is below this level (£9,100), your company won’t need to pay any employer’s NICs.

National insurance contribution rates 2023/24

Typically, business owners set their salary at a level that is greater than the Lower Earnings Limit in order to obtain the benefits of qualifying for the State Pension, but below the level where you’ll need to pay employee or employer’s NI.

If your salary for the 2023/24 tax year is greater than the Lower Earnings Limit (£6,396 a year) but lower than the NI Primary Threshold (£9,880 a year), you don’t pay employee’s NI contributions, but you do retain your State Pension contribution record. Your Limited Company would need to pay employer’s NICs on any income that is above the Secondary Threshold (£9,100).

Salary (PAYE)

Taking a reasonable salary via payroll is simply the most common way to withdraw funds from your business. The main reason to take a salary from your limited company is that it counts as an allowable business expense, which reduces your profit and, in turn, your Corporation Tax liability.

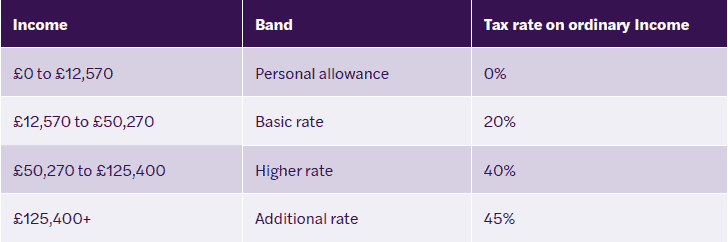

Income tax rates 2023/24

Your personal allowance is reduce by £1 for every £2 above £100,000 income.

By paying yourself a salary below £9,100, you will be above the Lower Earnings Limit, but you and your company will not be liable to Income Tax or NICs on that salary. Income Tax is calculated based on your yearly gross income and your tax.

Your 2023/24 personal tax allowance is £12,570, so you pay no tax or NI on earnings within this band and the salary is deductible against your company’s Corporation Tax bill. The £522.23 employer’s NICs could be refunded via the Employment Allowance (EA) scheme.

The EA will refund any employer’s NICs your company pays, up to a maximum of £5,000. However, you cannot claim the EA if you are the sole director of your company, and have no other employees. Your company will also save £659.30 in Corporation Tax if you decide to take a £12,570 salary instead of £9,100, while your income will be enhanced by £3,470 gross per annum. Overall, you and your company are better off paying yourself a £12,570 salary during 2023/24, if your company is eligible to claim the EA.

2. Benefits in kind (BIK)

BIKs are non-cash rewards that an employee may receive from their employer. The employee is receiving a benefit from their employer so will often have to pay extra tax on the value of the benefit. As an employer, you may also have to pay additional NI as they would have done so if they had given the employee more salary instead of the benefit. So, be mindful if you have BIK, as they will add to your PAYE salary and so could be liable to NI. Some common BIKs include:

Company car: A company car is considered to be a taxable perk, which means the owner of the vehicle must pay a benefit-in-kind tax value. The amount of BIK tax you pay will depend on the car’s CO2 emissions, P11D value and your Income Tax band. Your employer must pay employer’s NI on the car’s BIK value, which is 13.8%.

Private medical insurance: Where private health insurance is provided to employees, it is considered a BIK. This means that in most cases private health insurance is tax-deductible, and employees need to pay tax on any insurance premiums as reported in the P11D.

Essential information about company cars and BIK

If you were to drive an electric vehicle, the BIK is 2% from 2023/24 to 2024/25. This will rise by 1% per annum from 2025/26, capping at 5% from 2027/28.

- All hybrid cars receive a reduced BIK rate. Their lower CO2 emissions tend to reduce their BIK rates by at least 2%. Note that for diesel hybrids, the 4% diesel surcharge does not apply, since they are not classed as diesel powered cars, but alternatively fuelled vehicles for tax purposes.

- BIK rates start at 22% for petrol and RDE2 compliant diesel cars, with the rate increasing in up to 1% increments as CO2 bands rise, up to a maximum of 37%.

This tax is usually collected via PAYE. Unless the benefit is payrolled, the code number of the PAYE tax code is reduced to reflect the benefits. This means that more tax is deducted from the employee’s pay each payday. At the end of the tax year, the employer should give the employee a summary of the taxable benefits provided on a P11D form.

Did you know?

Director’s life cover (Relevant Life Assurance or death in service) is not seen as a BIK…

It is owned by the company and the premiums are paid by the company, which can be offset against Corporation Tax and are treated as a tax-deductible business expense. The company must pay the premiums and meet the conditions required by HMRC in order to receive favourable tax treatment. As this is paid for directly by the company this means there is also no income tax and NI. If possible, your life assurance needs should be funded by your company to reduce your personal outgoings.

3. Getting reimbursement of Business expenses

You should normally cover any business expenditure from your business bank account. However, there may be occasions when you have to make personal payments, particularly for smaller items from a retailer or travel costs if you don’t have a company credit card.

Provided the expenditure is wholly for business purposes, you can receive reimbursement for the costs. This is not a new personal income, unlike the other sources.

4. Dividends

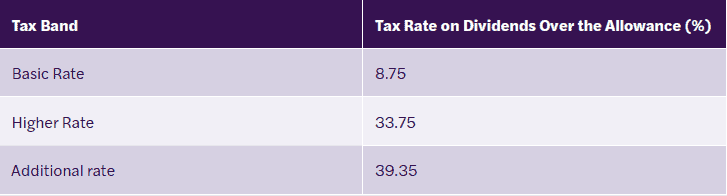

Typically, company directors take their pay as a mix of salary and dividends. Once all the business expenses and liabilities have been deducted, the remaining profit from your company can be distributed to shareholders as dividends. Each individual is allowed to have an annual dividends allowance of £1,000, which is taxed at 0%. Dividends greater than £1,000 are subject to Dividend Tax according to your Income Tax band. This will fall to £500 in 2024/25.

While the first £1,000 of your dividend is paid free of tax, it does use part of your personal allowance.

The ability to pay via dividends is one of the few perks available to business owners. It is one of the most tax-efficient ways to top up your salary because they only get paid when your business is profitable, compared to a salary, which can continue to be paid during a period of loss.

After this minimal salary, drawing further income via dividends can result in less tax, as dividends are taxed at a lower rate than salary. For example, in the 2023/24 tax year, the higher rate of Income Tax is 40% whereas the higher rate of Dividend Tax is 33.75%. Remember you have already paid Corporation Tax on your profits, so it’s not a massive concession.

Dividends are paid gross – there is no longer any associated tax credit – and all taxpayers receive a Dividend Allowance. Dividends not sheltered by the Dividend Allowance – or any available personal allowance – are taxed at the appropriate dividend rate of tax payable in January and in July, which is typically half the previous year’s tax bill, but this can be adjusted.

What are alphabet shares?

When a company pays a dividend, all shareholders receive payment in proportion to their individual shareholdings. For one shareholder to be paid in preference to another or be paid at a different rate, the company needs both to have different types of shares.

The term “alphabet shares” is used to describe different classes of shares in a company often set up as A, B and C and so on. This enables the company to pay shareholders different amounts of dividends depending on what share class they own.

5. Company pension contributions

I love pensions. Of course I do, I make a living arranging them! However, if pensions were launched today, we would all be waxing lyrical about their benefits. What is so good about them?

Well, first and foremost, I am passionate about helping business owners achieve financial freedom from the remuneration they can extract from their business without the need to sell, and pensions are a way of “throwing money over the wall” to build a pot that will provide a source of income when they retire.

The limit imposed on what a business can put into a pension for an individual each tax year is £40,000. This amount is reduced dependent on earnings, so you should check the maximum you are able to pay, and pay in whatever you can afford.

Tax benefits of company pension contributions

A payment made by your business into your pension is not personally taxable on you, avoiding Income Tax, NI and Dividend Tax (if payable).

- The payment into your pension is a legitimate business expense and will reduce your profits, and so your company’s liability to Corporation Tax.

- The monies go into your pension and on retirement, you may draw 25% up to the Lifetime Allowance (£1,073,100) free of tax.

- When you die, benefits can be passed to your spouse and beneficiaries and drawn tax-free if you die before age 75. This will not form part of your estate, so is not liable to Inheritance Tax.

- Pensions have the flexibility to invest in commercial premises, so any rent paid for by you or tenants accumulates within your own pension.

6. Arranging a director’s loan

You can arrange a director’s loan from your business to put funds into your personal account. Similarly, you can make a loan to the business if it needs funds for expansion or to cover unforeseen costs.

You should aim to repay the loan to the business within nine months after your financial year-end (when corporation tax due). If not, you will be liable to an additional tax charge, known as “S455”, on any outstanding balance.

A director’s loan is a useful low-cost or interest-free source of funds to meet short-term personal requirements. However, you should take advice on the tax implications before making any arrangements.

7. Winding up the company

If you cannot realise value by selling your business, you could consider winding-up a company . This is where the directors and shareholders of a company make the decision to place it into liquidation. It’s often chosen by directors as a means of taking control in the face of continued creditor pressure and the imminence of a Winding Up Petition.

The capital extracted from the company is treated as a capital distribution and is liable to Capital Gains Tax (CGT), rather than being taxed as a dividend. Business Asset Disposal Relief (BADR), formerly known as “Entrepreneurs’ Relief”, is a CGT relief that lowers the rate of tax paid on the disposal of business assets where the proceeds from the disposal are high enough to take you into the higher tax bands.

Chargeable gains covered by the BADR are taxed at an effective tax rate of 10%. You can claim a total of £1 million in BADR over your lifetime. The amount of BADR given depends on the amount of the individual’s BADR lifetime. If significant funds are available for distribution, this can generate considerable tax savings.

Be aware of the phoenixing provisions, where a new company is formed from the ashes of the previous, that is broadly similar company to the one wound up. Should this occur, HMRC may challenge the CGT treatment of winding-up the company and treat any payments received from the company wind-up as a dividend payments that would be taxed accordingly.

Advantage

- The liquidator winds up the company, which in turn minimises risk to shareholders who otherwise could be at risk of a creditor resurrecting the company for up to 20 years and making claims against them.

- This process ensures that the final distribution is subject to Capital Gains Tax rather than Income Tax or Dividend Tax. Hence the top rate of tax could be reduced from 45% to 10% if BADR is applicable.

- It reduces the risk for you as a director, as the process is administered by a licensed professional.

Disadvantages

- The control of the company’s assets passes to an insolvency practitioner, although this can be mitigated by prompt dividend distributions to shareholders.

- An advert for claims will be published for part of the closure process, but it will emphasise that the company is solvent.

8. Alternative investments

An unconventional way of extracting monies is by reinvesting into alternative investments that offer tax relief. An alternative investment is a financial asset that does not fall into one of the conventional investment categories, namely stocks, bonds and cash via an ISA or pension.

For the reasons outlined above, if you are able, you should typically complete your pension funding before considering alternative investments, which includes Venture Capital Trusts (VCTs) and/or Enterprise Investment Schemes (EISs). These cannot be funded by the business.

You would need to extract money from your business, maybe in the form of a dividend, which will be liable to Dividend Tax (rates explained above). You may then invest the proceeds into a VCT or an EIS. On doing so, you will receive up to 30% tax relief (capped at the amount of tax you pay), thereby offsetting some of the Dividend Tax and holding personal monies outside of the business.

EISs also allow you to defer any CGT liability, and gains accrue free of CGT, while values invested will not form part of your estate from an IHT perspective.

As an example…

Assuming you are a higher-rate taxpayer, and you have used your dividend allowance, a £30,000 dividend payment will create a Dividend Tax liability amounting to 33.75%, or £10,125. Reinvesting £30,000 into a VCT or EIS will reduce your personal tax liability by £9,000, resulting in a net tax liability of £1,125, an effective tax rate of 3.75%. Not bad eh?

It’s important to note that compared to traditional investments such as stocks, bonds, and mutual funds, alternative investments are more volatile and come with higher risks. You should only invest if you have a high net worth, are experienced at investing in the financial markets, are willing to take significant risk, and so can afford to lose the entire investment.

Furthermore, both VCT and EIS investments are relatively illiquid and have a minimum investment term of three and five years, meaning they are difficult to sell quickly. A wise investor might see alternative investments as a means toward diversification rather than the central strategy of a long-term plan.

9. Transferring cash into another company

This is complicated, and definitely one you should discuss with your accountant. However, if you have surplus cash, you could consider loaning monies into another limited company that you own via an intracompany loan. This may be a trading company, or possibly a vehicle for investment, to invest into the stock markets or to buy property. This loan would sit in your company balance sheet.

10. Transferring shares into another company

Alternatively, for commercial reasons, you could move some of your shares into another limited company under a share exchange. Provided this is no less than 25%, and you receive HMRC clearance, dividends may be paid into this company without liability to Dividend Tax, while on sale of your business, such shares are potentially not liable to Capital Gains Tax. Of course, there is much detail and conditions that need to be met plus other tax implications beyond the scope of this document.

This could be used inconjuction with a Family Investment Company planning. Again, it is complicated and detailed and conditions must be met, but can bring additional flexibility and planning to possibly offset your estate’s liability to IHT.

A final word

The obvious choice of selling the business is not considered here, but of course, with you being able to claim Business Asset Disposal Relief on a value up to £1 million paying Capital Gains Tax at 10%, and 20% on the rest, this is one way of extracting your cash and value from your business, but this entails you “giving away your train set”. If you would like to explore this option, we are here to help and welcome you to come back to us.

The successful business owners I have worked with over the years share many common traits. They have an excellent work ethic, are passionate about their business, and enjoy the trappings of success and wealth that a thriving business can deliver. They also pay a lot of tax.

We all have a moral duty to pay tax so that we can live in an orderly society and help those less fortunate than ourselves. However, business owners, largely through naivete, often pay more tax than is necessary and do not deal with dangers or take advantage of opportunities that are legitimately available.

If you would like to discuss any of the 10 ways to extract cash from your business, please contact us:

0121 313 1370

Please note:

This document does not constitute advice, and all such matters should be discussed with a suitably qualified tax accountant. This is purely for guidance and many of the areas mentioned are not regulated by the FCA.

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk, which may differ significantly. If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice. Tax rules may change in the future and taxation will depend on your personal circumstances. Charges may be subject to change in the future.