Most investors are aware that in the past few years the US market has delivered above average returns, compared to many other markets. There has also been quite a lot written in the media lately pointing out that just a handful of stocks have driven most of the US returns.

Some return-focused investors might look at this and wonder whether they should own more in the US. Fear of missing out (FOMO) might tempt them into increasing their exposure to the US or even these few specific stocks. Yet that would be to succumb to recency bias, where one is influenced largely by what has just happened and extrapolating this into the future. Someone who is so return focused should, to be consistent in their logic, be eyeing the Danish stock market which has outperformed the US over the past 20 years, by around 5% per annum on average, driven largely by one stock – Novo Nordisk, which is 60% of the market!

More risk-focused investors might be becoming a bit concerned by rising company concentrations in their portfolios, driven by the market capitalisation weights of individual companies, where the risk of either absolute failure or simply future underperformance is not appealing. Not doing something about this might become a source of both concern and ultimately regret.

There is a simple, systematic solution to this conundrum which is to own a portfolio that is exceptionally well diversified across markets, sectors, capitalisations (mega to small companies) and tilted towards value-oriented stocks. Looking under the bonnet using different ways of gauging diversification at the stock level provides insight into the portfolio construction choices on offer.

The outputs below look at the stock concentration of funds that:

a) track the US equity market using the S&P 500 index

b) track the developed markets (DM) by way of the MSCI World Index

c) provide globally diversified exposure to developed and emerging markets (EM) with tilts towards mid-cap and smaller companies, and value stocks[1].

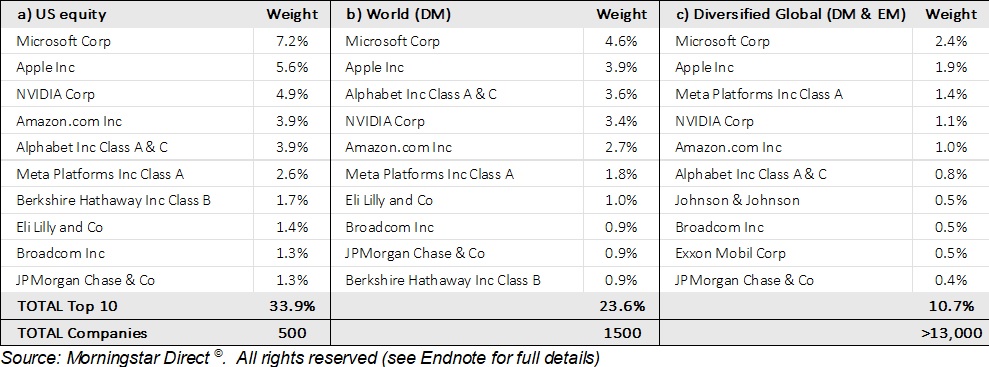

Table 1: Portfolio weightings of Top 10 companies compared:

Source: Morningstar Direct ©. All rights reserved (see Endnote for full details)

The first point of note is the difference in the total number of stocks in each portfolio. It is evident that the US market is highly concentrated with over a third of the market made up of just ten companies (left column). Diversifying into other developed markets (middle column) improves diversification with around one quarter of the portfolio made up of the ten largest companies, whereas diversifying into emerging markets and spreading out some of the allocation across smaller companies and value stocks (which have higher expected returns) provides material diversification (right column).

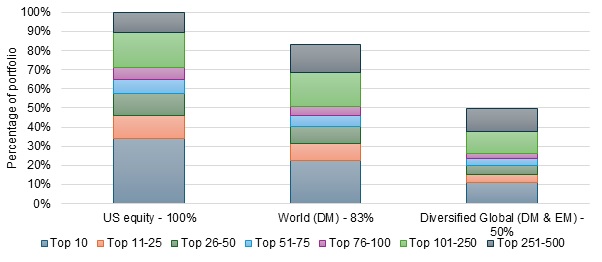

Expanding this analysis in the chart below, it is evident that the top 500 holdings in each of the three options represent from 100% of the portfolio in the case of US equities to only 50% of the diversified global equity option.

Figure 1: Comparing how much of the portfolio the Top 500 companies represent

Source: Morningstar Direct©. All rights reserved (see Endnote for full details)

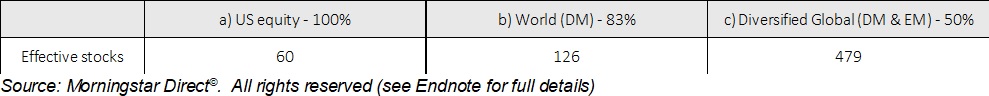

One final and slightly more technical measure of diversification is the number of ‘effective holdings in the portfolio. The calculation is based on the Herfindahl–Hirschman Index, a commonly accepted measure of market concentration, which was originally used by competition regulators to see the impact on industry concentration of mergers and acquisitions. The ‘effective’ holdings provide an estimate of the number of stocks that effectively represent the portfolio. It does not imply that the rest of the stocks are worthless and redundant – far from it – simply that they are dominated by the major stocks held.

Table 2: Effective stock holdings

Many investors would feel far more comfortable with 479 stocks dominating the portfolio than just 60.

Diversification matters because investors own portfolios today for the future and given that markets do a pretty good job of incorporating information into prices, we have no forward-looking insight into which company’s shares are going to outperform. We can avoid both FOMO and regret by walking a sensible path by owning a well-diversified portfolio.

Investment Risk Warning

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk which may differ significantly. If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Use of Morningstar Direct© data

© Morningstar 2024. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

[1] Funds used a) iShares Core S&P 500 ETF USD Acc b) iShares MSCI World ETF USD Dist. c) Dimensional World Equity GBP Dist. For illustration and educational purposes only. These are not recommendations of any kind. See Endnotes.