At times like this, we all risk being unsettled by the endless rounds of media speculation and hyperbole. Talk of market failure risk by the Bank of England, squabbling politicians and headline grabbing market traders and analysts can lead any investor to think that all is doom and gloom. A few months ago, the news was all about some of the dramatic falls in value of US tech stocks like Meta. Today it seems to all be about inflation and bond yield rises. If you are having to refinance a large mortgage at 6% instead of 2%, that might well hurt. But if you are an asset owner, being able to generate a yield of 4% on your short-term bonds going forward, it is much better than the miserly near-zero yields of a year or so ago. It is easy to get sucked into the frenzy and miss the wood for the trees.

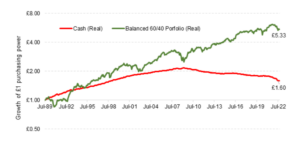

So let’s head back to calmer waters and take a look at the ‘traditional’ 60/40, equity/bond portfolio that provides a sensible balance between the upside, real (after inflation) return expectations from equities and the downside balancing exposure to higher-quality, shorter-dated bonds for longer-term investors [1]. The numbers below illustrate clearly that it has done a pretty good job since 1989 of helping investors grow the purchasing power of their assets. Cash is provided for comparison.

Source: Albion Strategic Consulting modal portfolio. Data from Morningstar Direct © All rights reserved [2].

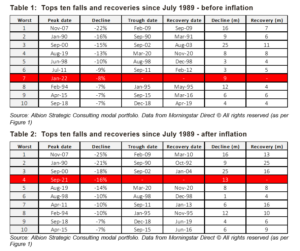

In the past ten years, up to the end of September 2022, investors would have achieved a more than 55% rise in their purchasing power. In 2022 such a strategy is down -8% before inflation and -16% after inflation. Although this is disappointing, it sits well within the bounds of expectation for a portfolio like this, as the data in the tables below show.

Ten tips for avoiding the maelstrom

At times like these there are a number of things that we can do to feel calmer and more in control:

- Read, watch or listen to less financial press and commentary (I know recently this has been difficult to avoid)

- Accept that investing is always a two steps forwards, one step back journey

- Try not to dissect your portfolio line by line – focus on the big picture

- Look at portfolio outcomes over the longest time frame you have available

- Remember that a fall in value is not a loss unless you sell

- Higher bond yields and lower equity prices point towards higher expected returns

- Attempting to jump in and out of markets is simply guesswork, and likely to be costly

- Place 2022 in context of your multi-year, or even multi-decade, investment horizon

- Keep your eyes on the prize of building future purchasing power over the longer term

- Keep the faith, stay invested.

Investment Risk Warning

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk which may differ significantly. If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice.

[1] The appropriate balance between bonds and equities for an investor can only be arrived at through a deep discussion between client and adviser. This analysis has been provided for educational purposes only.

[2] Diversified portfolio of global developed and emerging market equities tilted to value and smaller companies with a small allocation to global commercial property balanced with short-dated high quality bonds and a small allocation to index linked gilts. Index data to 12/2021 and live fund data thereafter. Full details available on request. Estimated current OCF costs deducted for all periods. Inflation – UK CPI. Cash – UK 1month T-bills to 2021 and SONIA for 2022.