If you’re thinking about getting professional help with your finances, you’ve probably considered contacting a financial adviser or a financial planner. You may even have searched for one of these terms online.

While ‘financial adviser’ and ‘financial planner’ are often used interchangeably, they mean two rather different things. So, finding the right person to help you means knowing the difference between what an adviser does, and what a planner can do for you.

Financial adviser or financial planner?

A financial adviser is traditionally someone who understands your financial needs, then goes out to source a product solution that meets your need. This might be a pension, an investment, or a protection contract, such as life insurance or Critical Illness cover.

The key issue here is that an adviser will typically provide advice on a product. They will find out about your current circumstances and make a recommendation about which product is most suitable for you.

It’s important to note that there is absolutely nothing wrong with this provided it is done ethically. Good advisers carefully tailor products to a client’s needs.

However, the question a financial adviser won’t answer is: “Are your savings and investment plans going to provide the amount of money you need to do all the things you plan to do in your life, both now and in the future?”

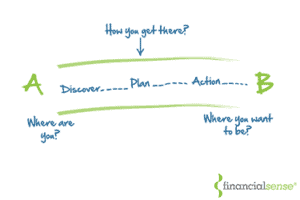

Unlike a financial adviser, a good financial planner will firstly get to know and understand you, your world and your objectives for the future. They are interested in your plans, your aspirations, and what you hope to do with your life.

They will then gather comprehensive information regarding your financial affairs so they can start to build a financial plan. This will typically consist of:

- A cash flow forecast – this will show whether your pensions and investments will provide the necessary income to allow you to do all these things you are planning

- Identifying any financial issues – for example, you don’t have enough life cover, you’re taking too little investment risk, there are Income or Inheritance Tax savings you could make

- Opportunities – any tax or planning opportunities.

This culminates in the generation of a financial strategy that will tell you how to mobilise all your resources to achieve better financial performance.

Then, and only once this process is complete, will a financial planner begin to source the products that are designed to help you achieve your objectives. It is very much a diagnosis before delivering the product prescription.

Working with a financial planner provides much more than simply a one-off trip to sort your pension or investments. Rather than just getting a return on your investment, a planner will help you to get the best life possible with the money you have.

Why our Chartered, Gold Standard service sets us apart from other financial planners

We have established that financial planning can add real value to your life. So, why should you choose Henwood Court as your financial planner? Here are just a few ways we’re different to other planners:

- We’re one of the largest independently owned firm of IFAs in the West Midlands. Our independence means we’re not tied to another financial institution, so you can be assured you’re getting truly impartial advice. Despite our size, we only work with a relatively small number of client families; a strategy which allows us to devote a significant amount of time and attention to each client relationship.

- You’re trusting a firm which has been recognised by the profession. We’ve been highly commended by both Moneyfacts and Money Marketing in the Retirement Adviser of the Year awards, and we are shortlisted for both awards again in 2020.

- Respected industry magazine New Model Adviser has named us as one of the top 100 financial planning firms in the UK. This is an annual list of financial planning businesses NMA think are doing a great job for clients as well as staff and contributing to the profession as a whole.

- You benefit from the peace of mind that we have achieved the Pension Transfer Gold Standard as set out by the Personal Finance Society. The Pension Transfer Gold Standard is a voluntary code of good practice for safeguarded and Defined Benefit pension transfer advice. Choosing a firm that has achieved this standard gives you the reassurance you are dealing with someone with superior levels of skill and expertise, high ethical standards, and transparency in advice and outcomes.

- A unique investment strategy that continues to deliver strong performance. Our ongoing portfolio management service, Portfoliosense®, is a proven, low cost, ‘honest’ investment strategy that has consistently delivered outperformance.

- Expertise and experience. Our team are highly qualified, experienced financial planners who know their stuff. This is not demonstrated just through exams but through practical advice – just look at our MD’s book Retireability for evidence of our know-how.

- We’re proud to be Chartered Financial Planners, as awarded by the Chartered Insurance Institute (CII). To secure Chartered status, firms must demonstrate the highest levels of technical knowledge, a commitment to the ongoing development of our skills and knowledge, and an adherence to ethical conduct. Chartered status is the ‘gold standard’ of financial planning and it means you are working with one of the UK’s leading practices.

Of course, it’s easy for us to showcase our skills and expertise, and the high regard in which we are held by the financial planning profession.

However, don’t just take our word for it. Our clients are always happy to share their stories, and to explain how financial planning enabled them to live the lives they had always wanted. Hear from our clients.

Get in touch

We’re very much ‘open for business’ right now and our financial planning service can be delivered remotely. To find out what we can do for you, please email info@henwoodcourt.co.uk or call 0121 313 1370 to book your chat with a Chartered financial planner.