23 March 2020, a date not many people may remember, but a day that we will recall as Boris Johnson announced the UK’s first Lockdown and instructed people to ‘stay at home’. At the time there were many questions going through everyone’s minds; “Can I see my family?”, “How long will this last?” and “What about work?”.

In addition to the initial uncertainty and concerns over health and loved ones, aisles in supermarkets started to empty as panic took hold.

Following this early panic, and now 12 months on, we look back at some of the key dates which have shaped our lives during these challenging and concerning times:

16 April 2020 – Lockdown is extended for ‘at least’ three weeks.

10 May 2020 – Boris Johnson announces a conditional plan for lifting Lockdown, and states people who cannot work from home should return to the workplace but avoid public transport.

1 June 2020 – The phased re-opening of schools in England starts.

23 June 2020 – Boris Johnson says the UK’s ‘national hibernation’ is coming to an end and announces a relaxing of restrictions and 2 metre social distancing rule.

29 June 2020 – More restrictions are eased in England, with the reopening of pubs, restaurants and hairdressers.

14 October 2020 – A new three-tier system of COVID-19 restrictions commences.

31 October 2020 – Boris Johnson announces a second Lockdown in England to prevent ‘medical and moral disaster’ for the NHS.

2 December 2020 – Second Lockdown restrictions end after four weeks with the return of the three-tier system of restrictions, whilst the UK becomes the first country to approve the Pfizer/BioNTech Coronavirus vaccine.

8 December 2020 – The first vaccine is administered in the UK.

15 December 2020 – Boris Johnson announces tougher restrictions for London and South East England within a new tier 4, and previous rules surrounding Christmas gatherings are amended.

4 January 2021 – Boris Johnson says children should return to school after the Christmas break, but warns restrictions will get tougher.

6 January 2021 – England enters a third national Lockdown.

22 February 2021 – Boris Johnson announces a roadmap for ‘irreversibly’ lifting Lockdown.

8 March 2021 – Schools reopen for primary and secondary school students in England.

These events and announcements have led to every one of us having our own unique story to tell, both happy and sad, as the above timeline unfolded.

The aisles at the supermarkets have been restocked, parents have unearthed teaching skills at home whilst juggling their work commitments and many people have adapted to working from home. The bustling high streets and hospitality sector ground to an almost complete halt along with flights around the globe. Many families have sadly dealt with the loss of loved ones, whilst mental health has become even more imperative.

What impact has the above had on the UK and global markets?

The above timeline caused a number of uncertainties for everyone, and the same can be said for global markets as the measures taken by each country resulted in increased volatility in stock markets.

To consider the full impact on markets we need to go slightly further back to mid-February 2020, which is the point global markets started to feel the full impact of the COVID-19 pandemic as it spread across the world.

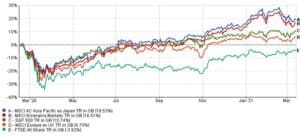

The following graph highlights the performance of a selection of major global indices between Monday 17 February 2020 and Friday 12 March 2021:

Source: FEfundinfo 2021

From the above, we can see that the FTSE All Share Index reached its lowest point as the UK Lockdown was announced. This reflects the market’s sentiment to the uncertainty Lockdown brought and what the future held. However, from this point onwards, the index starts to recover, albeit with increased volatility.

The introduction of two further Lock downs did not result in the same level of market decline as seen in March 2020. Some of the contributory factors here would have been slightly relaxed restrictions in comparison to the first Lockdown, but also businesses and individuals evolving to deal with some of the challenges faced by Lockdown restrictions.

Across the globe it is a similar story, however the recovery across the highlighted indices have been faster than the UK and are now ahead of pre-pandemic levels.

When comparing the UK to its global counterparts, we can see that the UK is still lagging behind and remains fractionally below its pre-pandemic level. As covered in our quarterly investment commentary, in addition to the pandemic, the UK has also been impacted by the composition of the FTSE All-Share Index which is packed with traditional companies such as banking, finance, construction, and engineering firms all of which have been adversely impacted by the pandemic, whilst the Brexit trade deal deadlock caused a high level of uncertainty which was stifling any UK market recovery.

The market volatility we have seen during the COVID-19 pandemic highlights the importance of remaining invested during turbulent times, as success in stock markets is about time and patience. Investing in the past has been described as ‘like watching paint dry’ due to this approach.

Based on the above graph, if an investor had exited the markets before the start of July, then a loss would have been realised over the short term. Therefore, the resultant growth opportunity would have been missed with the recovery over the coming months.

During periods of high volatility, it is important to keep emotions in check, and it is crucial for investors to hold on for the long-term, ride out the storm and let investment markets recover as we have seen throughout 2020 and early 2021. This will allow investors to benefit from the returns that the markets achieve over the long term.

This approach highlights why an important aspect of every successful long-term investment strategy is to maintain sufficient cash reserves separate to your long-term investment portfolio to fund any projected short-term financial commitments.

This allows you to sustain a long-term commitment without having to draw from the funds, potentially when the markets are falling or as low as we saw at the start of March 2020. The amount of this dedicated reserve should be carefully determined and not be allowed to influence the long-term investment portfolio.

Please remember that we at Henwood Court are here, not only during periods of investment volatility, but always, to offer ongoing support and guidance.