Despite the doom and gloom of rising interest rates, elevated inflation, the fear of a wide recession and the continued war in Ukraine, global equity markets (developed and emerging markets combined) have actually risen in 2023. In GBP terms, they have delivered a return of around 7.2% in the first half of 2023, recovering most of 2022’s fall.

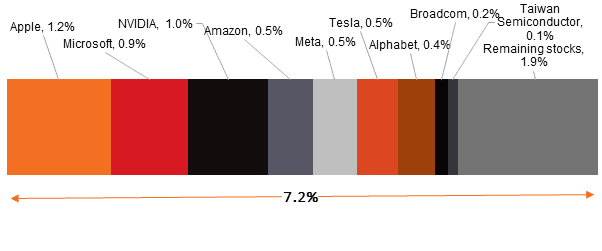

As we know, markets are forward looking and pretty good at reflecting all information publicly available to investors in current stock prices. As is evident from the chart below, the forward looking market view for a very small number of stocks has been extremely positive and this has been reflected in an extraordinary and rapid upsurge in their prices.

Some speculate that this may be due to the market pricing in its view on the benefits of the AI revolution for these stocks. In fact just nine companies accounted for three-quarters of the 7.2% rise in global markets this year to the end of June. The remaining stocks in the global markets delivered just a quarter of the total 7.2% rise. It is interesting to note that Apple Inc. now has a stock market valuation of over US$3 trillion, which is around two-thirds the size of the entire UK stock market.

Figure 1: The contribution to the global equity market return of 7.2%

Source: Based on returns of Vanguard FTSE Global All Cap Index (£ Acc). This is not a recommendation but for illustrative purposes only.

The important thing to note is that no-one knew that the rapid rises in these companies’ stock prices were going to happen in advance. Similarly, no-one knows where they go from here. Prices move on the release of new information which is, by definition, random. It may be good news for these companies, or it may not be.

Such concentrated price moves may make some investors wish that they had held more in these stocks, but that is to succumb to the power of perfect hindsight, which everyone wishes they had. Others will feel a fear of missing out (FOMO) and dive in hoping that recent past gains continue, succumbing to recency bias. Investors in sensible, evidence-based strategies like Portfoliosense®, will simply feel glad that they have captured the market returns using the wide net of a well-diversified index fund or similar systematic fund.

Investment Risk Warning

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk which may differ significantly. If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice.