Absolute return funds? Absolutely not!

The fear of losing money is a very real emotion and the marketing promises of absolute return funds, “no losses and high returns”, may be appealing to some. Most absolute return funds aim, as a minimum, for a positive return over a specified time horizon, with a return target of cash plus something, often in the range of +2% to +4%. Due to these promises, some investors see absolute return funds as a “safer bet” then the more traditional asset classes.

To put this promise in perspective, cash plus 4% is similar to the long-run return on equities, which can and have fallen as much as 50% at times of market crisis. No short-term losses and an equity like return is an easy promise to make but a hard one to keep. Alarm bells should be ringing.

To avoid absolute losses over a short-term timeframe there are three avenues that can be pursued:

- The first is to take little investment risk and own cash-like investments. After fees this would fail to satisfy the marketing proposition of cash plus returns.

- The second is to simply own a portfolio of riskier assets and hope that markets work in your favour over the short-term. Luck is never a good long-term strategy.

- The third is to employ the forecasting skills of an active manager to move the portfolio around to manage risk and capture returns. That is a big challenge, given that we know that markets work pretty well, forecasting is very hard and skill is a rare commodity.

The Investment Association, the UK investment industry’s trade body, has established a fund sector known as ‘Targeted Absolute Return’ (TAR), incorporating funds which seeks to deliver positive returns over a stated time horizon, usually 12 months or 36 months.

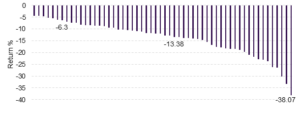

Let us see how well they have delivered on their promises. The figure below reveals the worst 36-month outcomes for all 56 funds with a clearly stated target of positive returns over this horizon.

Source: IA (see footnote). Period to 31 July 2022

Oh dear!

In addition, the 30 funds in this IA sector that have a stated 12 month positive return target all exhibited losses over a 12 month period.

Perhaps the first conclusion that can be drawn is that absolute return funds push the boundaries of any sensible definition of what they purport to represent. The second conclusion is that they have a better marketing spin than their real world outcomes. Risk and return are related and this trade-off is rarely overridden by active management skill. The final and most important conclusion is that there is unlikely to be a place for them in a diversified, well-constructed portfolio for investors with longer-term horizons.

Only asset classes (and their underlying risk-factors) that are understood with a high degree of confidence and have suitable theoretical or empirical support, are selected to construct Portfoliosense®.

Absolute return? Absolutely not!

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.