One of the economic consequences of the coronavirus pandemic has been the Bank of England’s decision to reduce interest rates to a record low.

In the last few weeks, the Base rate has fallen from 0.75% to just 0.1%, the lowest it has ever been in the bank’s 326-year history.

While this may represent good news for anyone looking to borrow – especially if you have a tracker-rate mortgage or loan – it’s not been good news for savers. Rates on many accounts have fallen to negligible levels, meaning that anyone who is keeping their money in cash right now is likely to be losing money once the effects of inflation are taken into consideration.

Rates cut on more than 600 savings accounts

New research has found that the savings market has been hit hard by the coronavirus pandemic and the two recent cuts to the base rate.

Figures compiled by Savings Champion, an industry analyst, for Telegraph Money found that 111 savings accounts now pay less than the Bank Rate, which stands at 0.1%. In addition, many more banks and building societies are expected to cut their rates in the coming weeks.

Rates on more than 600 accounts have been cut since the first Base rate reduction on 11th March or will be reduced shortly.

In some cases, the drop has been much more than the 0.65 percentage point fall in the Bank Rate. For example, the rate on the Britannia Select Access Saver (issue 10) will be lowered by 0.85% to 0.55% on 24th June.

Big names including Barclays, HSBC, Lloyds, NatWest and Royal Bank of Scotland have all announced rate cuts that will see savers earn just 0.01% interest from some accounts.

Based on the average cash ISA balance of £5,114, the Telegraph reports that it would take a saver 20 years to earn just £10 from an account that paid 0.01% interest.

Rachel Springall, finance expert at analyst Moneyfacts, said: “These changes may well be just the beginning, as it can take up to three months for a Base rate change to be passed onto savings accounts.

“In light of this savings market trauma, it has never been so vital for savers to take stock of their existing account to be sure they are still earning a reasonable return. Switching quickly is crucial if savers want to get the most lucrative rates and providers will need to act swiftly to cope with demand and keep a close eye on their peers positioning themselves in the top rate tables.”

While recent weeks have seen the rates cut on hundreds of cash savings accounts, there was one piece of good news from National Savings & Investments. NS&I accounted recently that it had reversed planned changes to Premium Bonds and variable-rate accounts, retaining interest rates and Premium Bond prizes at the same levels.

ISA rates also withdrawn or slashed

If you hold your cash savings in an ISA, then you haven’t escaped the recent reductions in interest rates.

For example, Yorkshire Building Society has cut the rate on its Help to Buy ISA by 1.25% to just 1%, while Chelsea Building Society has reduced the top rate on its e-ISA Plus from 1.35% to just 0.25%.

As it’s the start of the new tax year, April ordinarily sees strong competition between providers and there are often some eye-catching interest rates available to savers.

This year, however, the combination of Base rate reductions and the coronavirus pandemic has resulted in ISA savers facing a disappointing April, with many providers pulling their ISA deals. Indeed, between 1st March and 1st April 2020, 77 ISA deals were withdrawn from the market and the average easy access ISA rate fell from 0.83% to 0.79%.

Savers losing in real terms

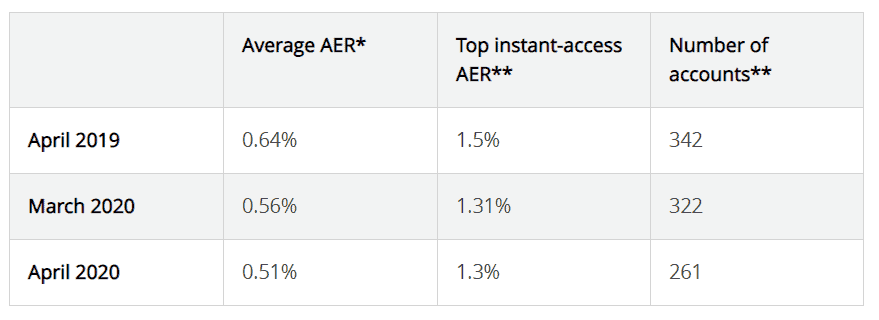

The Telegraph recently reported that the average easy access savings rate fell from 0.56% in March to 0.51% at the beginning of April.

* Data from the 1st of the month. **Data from 1 April 2019, 19 March 2020 and 15 April 2020. Source: Moneyfacts.

Savers holding their cash in these types of products are seeing their money eroded by the effects of inflation. Even the top-paying instant-access account in the chart above pays an AER of 1.3%, 0.4% lower than the current UK inflation rate of 1.7%.

Many savings rates withdrawn in wake of pandemic

The recent Base rate cuts haven’t just resulted in a reduction in interest rates; they have also led to a fall in the choice of savings products available.

Moneyfacts found that, from 1st March to 1st April 2020, 180 savings products had been withdrawn from the market.

Rachel Springall from Moneyfacts, added: “Savers will be disappointed to find that deals are being pulled left, right and centre, and this vanishing act is clearly due to the base rate cuts last month and uncertainties surrounding the Covid-19 pandemic.

“Providers are perhaps struggling to sustain their lucrative offerings or are pulling deals because they have crept up the top rate tables unexpectedly, resulting in a domino effect of cuts or withdrawals.”

Get in touch

If you’re concerned about the return you’re achieving on your savings, or you’d benefit from a financial review, we can help. Email info@henwoodcourt.co.uk or call 0121 313 1370.

Please note:

The Financial Conduct Authority does not regulate NS&I products.