One of the main talking points following the Chancellor’s Budget on 27 October 2021 was in relation to inflation forecasts for 2022.

Within his speech to the Commons, Rishi Sunak said inflation was 3.1% in September and is “likely to rise further”. The government’s forecaster says inflation is set to jump to an average of 4% in 2022, although the Office for Budget Responsibility (OBR) says figures released since the original report suggest inflation could hit almost 5%.

The adverse impact inflation has on areas like everyday expenses and interest rates are well documented, however, does inflation have the same impact on stock market returns?

To try and understand if any relationship exists, we have taken a look back at the historic performance of the FTSE All Share Index since the UK Consumer Price Index (CPI) was introduced in January 1989.

We have used CPI as this is the index that the Bank of England measures for their inflationary targets. The comparison with the FTSE All Share Index provides a relevant domestic based evaluation and is currently the index tracked for any specific UK exposure within our investment strategy, Portfoliosense®.

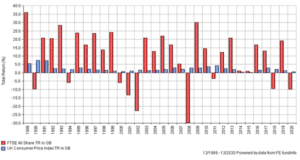

The annual performance of these two indices since January 1989 is as follows:

The above indicates there is no correlation, whether negative or positive, between inflation and the FTSE All Share returns, as negative returns have been experienced during periods of both high and low inflation and vice versa for positive returns.

Since 1989, the FTSE All Share Index has recorded annual returns in excess of CPI for 23 of the 32 years reviewed. Of the periods where the FTSE All Share Index has underperformed CPI, a number of these instances can be related to events which caused stock market turbulence e.g. the Tech Wreck (September 2000 to January 2003) and the Credit Crunch (November 2007 to February 2009).

Whilst the above graph shows the fluctuations and volatility in performance of the FTSE All Share Index, the FTSE All Share Index has recorded an average annualised return of 8.86% compared with the average annualised return of 2.50% for CPI (source: FE Analytics).

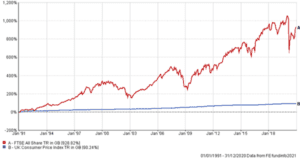

To understand the compound impact of the above average annual rates, the performance of the two indices since January 1989 to December 2020, can be seen as follows:

Collectively, the above highlights that historically the FTSE All Share Index tends to outperform inflation on average and compounded over the long term, and therefore offers some reassurance that even if inflation does rise, an investor’s exposure to stock markets should offer some protection to these rises, although it obviously places greater pressure on the asset class which is primarily adopted for capital growth.

It is worth noting that the above is solely based on the position in the UK, and Portfoliosense® is a globally diversified investment strategy, therefore the same themes may not be seen across other global markets. However, inflation is only one of the challenges investment portfolios faces, and this why we recommend that a globally diversified portfolio is adopted.

Please note: The value of investments and any income from them can go down as well as up and investors may get back less than the amount they originally invested. All investments carry an element of risk which may differ significantly.