Getting onto the property ladder has rarely been more difficult. A combination of rising house prices, stricter lending criteria, and low wage inflation has seen thousands of young people turn to their parents for help.

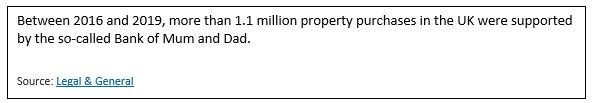

Indeed, parents have lent more than £23 billion over the last four years to help their children to get onto the property ladder.

Source: Legal & General

Source: Legal & General

In recent years, the Bank of Mum and Dad has grown in size and is now the UK’s tenth biggest lender, providing more finance each year than the Clydesdale Bank and the Skipton Building Society.

An estimated £6.26 billion of assistance was provided by parents to help fund their children’s property purchases in 2019, with Legal & General research estimating that parents are lending or gifting an average of £24,100 to help their children.

You may be thinking of opening the doors to the Bank of Mum and Dad either now or in the future. So, before you write a cheque, here’s a guide to all the factors you need to consider.

Is your assistance a gift or a loan?

If you’re thinking about helping your child onto the property ladder, one of your first considerations should be: Is the financial assistance a loan or a gift?

A recent joint study by the London School of Economics and the Family Building Society found that three-quarters of survey respondents said that financial assistance was given as a gift, with 23% saying it was a loan.

Gifting money

Gifting the money to your child is one way to help them onto the property ladder – but beware of the tax implications.

If your estate is subject to Inheritance Tax (IHT), your gift could incur a 40% Inheritance Tax charge if you die within seven years of the money being gifted.

If you survive for seven years after making the gift, it will no longer form part of your estate, meaning no IHT is due.

If possible, it can be better to avoid making a large, single gift. For example, each individual has an annual £3,000 IHT gift exemption, where you can gift up to £3,000 without an IHT charge.

Another concern that many parents have when making a gift is that any money they gift may not end up with their intended beneficiary. You might make a gift to your child but, if they separate from their partner, part of this gift might end up with an estranged spouse.

The Times recently reported a case where a couple spent £380,000 on legal fees following their son’s divorce as they did not want their former daughter-in-law to be awarded half of the £2 million home they had funded.

By formalising the arrangement and taking these steps, you will benefit from the peace of mind of knowing your gift will remain with the intended beneficiary.

Lending money

There are times when parents can gift what they think is an affordable amount to a child, only to find their own circumstances later change. Redundancy or ill health can then leave them short of money.

A loan may, therefore, be a useful option. It allows you to keep some control over the money, and there is an understanding that this money will be repaid to you.

The recent London School of Economics and Family Building Society study found that, of those parents who provided loans, most (82%) were not charging interest and about two-thirds said they expected repayment as and when the beneficiary could afford it, rather than agreeing a fixed repayment schedule.

It’s important to remember that a loan could still be subject to IHT because it will count as part of your estate when you die. A loan will only be exempt from IHT if you decide to waive the debt and gift the money instead – and assuming that you live for at least seven years after making the gift.

Bear in mind also that, while most parents choose not to charge their children interest on a loan if you do, you could be taxed on the interest because it will be treated as income.

One criticism that is often directed at parents who are lending money as the Bank of Mum and Dad is that they don’t ‘act like a bank’.

When lending money, Helen Morrissey, personal finance specialist at Royal London, warns that it’s important to be clear what the expectations are on both sides and to think through what would happen if repayments could not be kept up.

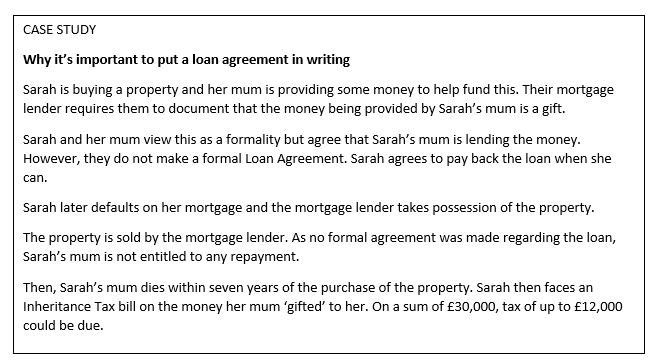

Even though you might be family members, experts recommend that you get a loan agreement written up in order to make the terms clear and avoid issues in the future. Helen says: “Arguments over whether money needs to be repaid, or over what time period, have the potential to cause considerable harm to the parent/child relationship. It may seem very formal, but all parties should consider taking legal or financial advice and, if needs be, get something down in writing. Taking this approach can bring much needed clarity to the process and save both parties a lot of grief.”

Whether it’s a gift or loan, get the right paperwork in place

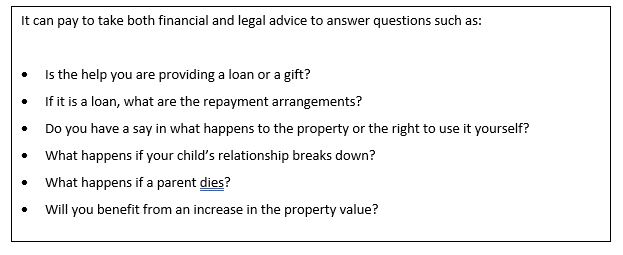

Whether you are gifting or lending money, it’s vital that you get the right paperwork in place.

While there might be a general expectation within your family that you will provide some financial help, the details of how this would take place (loan or gift, repayment schedule, what would happen if the couple split up) should be worked out in advance.

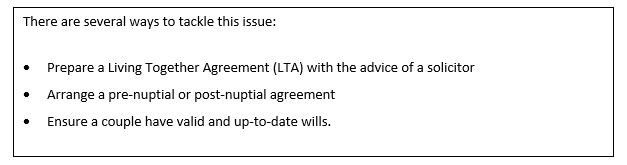

For example, experts recommend that a Living Together Agreement is prepared, particularly if your child is unmarried and buying with someone else.

This gives you the opportunity to sit down with your child and their partner and discuss (and record) details of the financial contribution you are making, and what will happen if the relationship were to end.

If your child also intends to allow another person (for example, a partner or friend) to live at the property, it is a good idea to create a Tenancy Agreement, as well as a Living Together Agreement. This helps to set out the rights and responsibilities of each party.

As well as making it clear who owns the property, it also sets the expectations for meeting the costs of living.

Factors to consider if you’re thinking of opening the doors to the Bank of Mum and Dad

The consequences of not ‘acting like a bank’

As we have seen, if you are lending or gifting money to a child to help them buy a property, it’s vital that you get the right paperwork in place.

Mark Bogard, chief executive of the Family Building Society, says: “While parents are happy to help their children, there is rarely any discussion about how any money should change hands or be repaid.

“Failing to carry out some basic planning and documentation can store up a whole host of problems if things go wrong. Things such as the break-up of relationships, the death of one or both parents, or the need for parents to contribute to care costs in future, all need to be considered.”

The Sun recently reported that a rising number of parents are now going to court to recoup the money they have provided to their children. Estimates suggest there are now 12 to 15 cases every month where parents take their adult children, or their child’s spouse, to court in order to retrieve their money.

Family law barrister, Greg Williams, told the newspaper his workload has trebled since 2014. He believes that the most common reason parents want their money back was when their children and their partner split up.

He said: “A frequent example is where the parties agree that the parents of one of them contributed a large sum to the purchase of the property, but they cannot agree what the basis of that contribution was. Was it a gift, a loan, or an investment leading to a beneficial interest?”

Leaving yourself short of money

Whilst gifting or lending loved ones the money to help them buy their first home can be rewarding, you do need to look at the long-term picture.

The sums being handed over can be significant, with Legal & General reporting that the average amount lent/gifted now stands at £24,100. Their research also found that:

- 15% of over-55s have accepted a lower standard of living after helping family buy a home

- 21% dipped into ISA savings, 7% used their pension drawdown and 6% used income delivered from Annuities

- 16% unlocked housing wealth through a lifetime mortgage to provide financial support

In many cases, these approaches won’t be an issue in themselves. However, it’s worrying that more than a quarter (26%) of Bank of Mum and Dad lenders are not confident they now have enough money to last throughout retirement, while 10% also said they no longer feel financially secure.

These figures were backed up by the LSE research, which found that 24% either ‘agreed’ or ‘strongly agreed’ that they were concerned about the future effect [of gifting/lending money] on their finances’.

Alternatives to the Bank of Mum and Dad

Alternatives to the Bank of Mum and Dad

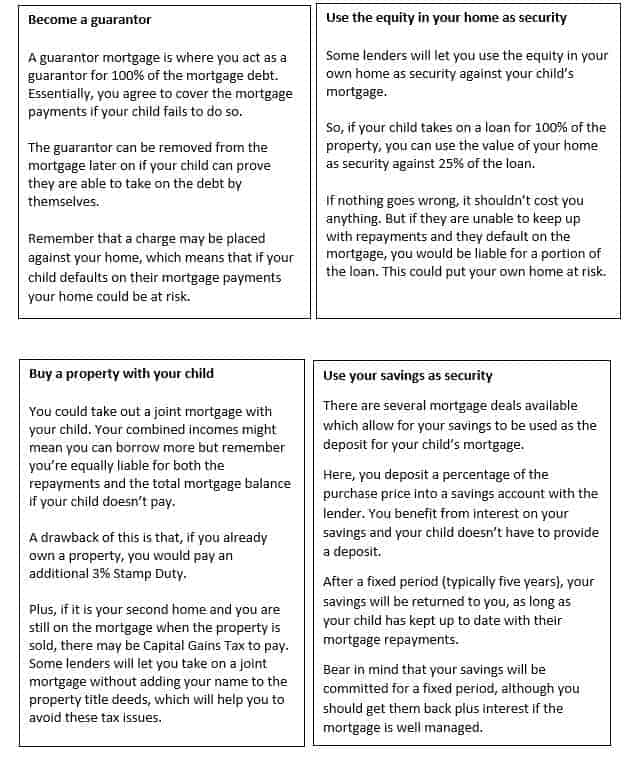

With the average amount of assistance now standing at £24,100, for many people, a financial loan or gift simply isn’t an option. However, there are other ways you can provide support to your child.

Get the help you need

As we have seen, getting expert legal and financial advice is important. Without it, you could leave yourself in a difficult position with your child, both financially and emotionally.

A financial planner can help you to establish whether any gifts you intend to make are affordable and can also help you with the tax and estate planning implications of becoming the Bank of Mum and Dad.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Think carefully before securing other debts against your home.

Equity Release will reduce the value of your estate and can affect your eligibility for means-tested benefits.

The content of this newsletter is for information purposes only and is based on our current understanding of HM Revenue & Customers guidance and tax legislation. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. Seek professional advice.