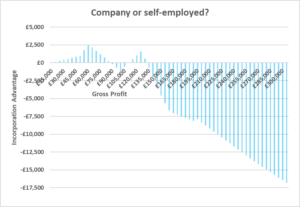

We last looked at the relative benefits of incorporation a few years ago, shortly after the last Chancellor but three announced the planned increase in corporation tax rates from 2023. Since then, there have been several changes (and reversals) on income tax rates and national insurance (NICs). We therefore thought that we would be beneficial to revisit the graph which showed the financial benefit (or otherwise) of moving from self-employment to a corporate structure based on gross profit levels.

Do not forget this exercise is a largely academic one which looks only at the tax and NIC numbers. There will be many other factors (and costs) in the incorporation decision, e.g. the impact of the High Income Child Benefit Charge, the treatment of pension contributions, possible legal protections offered through incorporation and the increasing corporate governance requirements.

For the above calculations it is assumed that:

- Corporation tax from April 2023 is:

-

- 19% for companies with profits up to £50,000;

- 19% on the first £50,000 and 26.5% on the next £200,000 of profits, for companies with profits between £50,000 and £250,000; and

- 25% for companies with profits of £250,000 or more.

- Income tax rates (outside Scotland) in 2023/24 are 20%, 40% and 45%, with corresponding dividend tax rates of 8.75%, 33.75% and 39.35% respectively.

- The NIC rate for employers is 13.8% on earnings above £10,036 (assuming the secondary threshold rises by about 10% in 2023/24).

- The NIC rate for director employees is 12.0% on earnings between £12,570 and £50,270 and 2% on earnings above that level.

- The NIC rate for the self-employed is 9% on profits between £12,570 and £50,270 and 2% on profits above that level. In addition, there are Class 2 NICs, also assumed to rise by about 10% to £3.45 a week.

- The director draws a salary from gross profits equal to the primary NIC threshold (taken as £12,570 in 2023/24), thereby incurring an employer NIC liability of around £350 on the above assumptions. This level of salary is generally more tax-efficient than keeping pay to the secondary threshold and avoiding all NICs.

- Beyond the salary and small NICs liability, the balance of profits is taxed at the appropriate corporation tax rate(s) and then paid in full as a dividend.

- The dividend allowance is used elsewhere.

- The Employment Allowance (EA) is used against other employee earnings, or is otherwise unavailable.

The mathematics brings out the following points:

- From about £15,000 to £88,000 of gross profits, there is an advantage from incorporation. The peak advantage is around £60,000 of profits, where the saving is £2,460, primarily because of the much-reduced exposure to higher rate tax that the mix of dividends and pay produces at this level. Remember, for the self-employed, gross profits and taxable income are the same. The following applies in the higher rate income tax band when corporation tax rate is at the marginal (26.5%) on taxable profits above £50,000 and explains the falling benefit past £60,000:

- From £88,000 to about £110,500 incorporation shows a disadvantage because the combination of the higher rate of corporation tax and personal tax rate on dividends overhauls the NIC savings compared to self-employment (please see the table above).

- Incorporation savings then re-emerge from about £110,500 to £132,000. This blip occurs because the combination of dividend plus salary produces a lower gross personal income, preserving the personal allowance for longer and thus sidestepping the 60% marginal income tax rate. With no grossing up of dividends, it requires £87,430 of dividends plus £12,570 of salary before taper bites – equivalent to about £127,000 of gross profit.

- Beyond £132,000 of gross profits, the combination of the higher rate of corporation tax and personal tax rate on dividends reasserts itself, making incorporation less attractive. In the additional rate band, a similar gap in favour of salary over dividends occurs when the 26.5% marginal rate applies:

Finally, once the 25% overall rate of corporation tax is reached at £250,000 of taxable profits, this is the picture:

Credit: Techlink