The second quarter of 2023 was a strong one for investments. That should come as something of a surprise given that this was a quarter in which central banks were taking most, if not all, of the opportunities to raise interest rates.

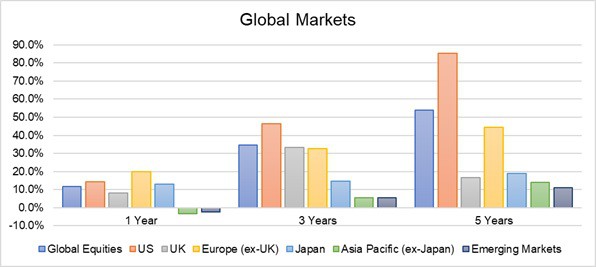

Global markets have had a positive quarter, recording a return of 3.2% and builds on the strong performance in Quarter 1.

In the first quarter, a cohort of mega cap tech stocks delivered exceptional returns, with this positive trend continuing in the second quarter as enthusiasm over Artificial Intelligence continued throughout the world. Unsurprisingly, the U.S emerged as the top performing market with a return of 5.8% due to the US markets have a large exposure to tech companies.

The US has also seen inflation fall to half of last year’s peak and whilst the Federal Reserve (Fed) raised interest rates by 0.25% in May, it did not increase rates in June. Finally, politicians debated the debt ceiling, and after much back and forth, a deal was agreed to raise the debt limit, avoiding the impending possibility of a US default.

Closer to home, after starting 2023 with gains, the UK recorded a marginal fall of -0.5% over the quarter. The UK characterised by its abundance of oil majors and other cash-generative stock faced challenges in comparison to other developed markets. The absence of mega cap tech companies capable of capitalising on the recent Artificial Intelligence hype contributed to the lag in performance.

Furthermore, the UK’s relatively turbulent political landscape and persistently stubborn inflation served as additional deterrents for investors.

In Europe, a small gain of 0.6% has been seen, with the financial and IT sectors being the main contributors. The Dutch government confirmed that high-end chip manufacturing machines will require a license to be shipped overseas, which could lead to reduced exports to China. The Netherlands is home to some leading chip equipment makers. During the quarter Europe also saw a decline in headline inflation, estimated to be at 5.5% in June, down from 6.1% in May.

In the Emerging Markets, a fall of -1.7% was recorded. Whilst tensions between the US and China were a contributing factor, the economic rebound, following the country’s reopening after the Covid-19 crisis, started to cool. Factory output in China has started to slow due to lacklustre consumer spending and weak demand for exports following interest rate rises in the US and Europe.

Hungary, Poland and Greece were the top-performing index markets despite rising recessionary fears in Europe. Central European markets began to anticipate rate cuts as inflation eased, and Hungary cut rates in June. Meanwhile, Greece’s outperformance came as the ruling New Democracy party won a second term in office in May, signalling a continuation of market friendly policies.

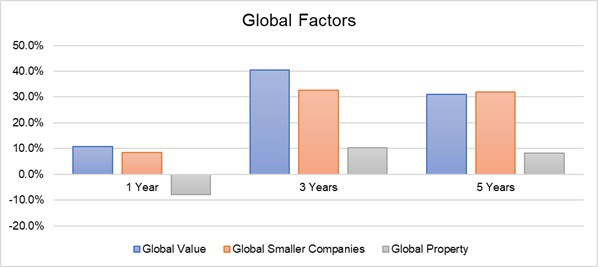

Value and Smaller Companies have seen a positive return for the quarter and continue to show reasonably strong returns over the last 12 months. Value in particular last year rewarded disciplined investors with its largest one-year outperformance of growth since 2000. Whilst Global Property recorded a loss, the diversification benefits it brings to portfolios due to not being correlated to global equities is still an important factor to hold.

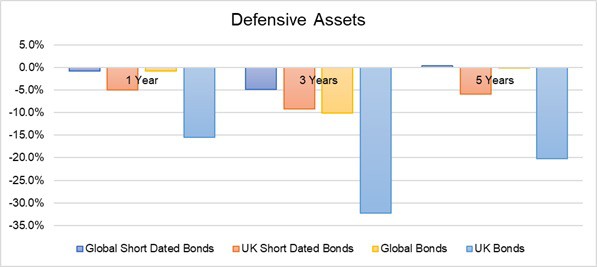

The second quarter of 2023 saw a significant drop in Global Bond market volatility. Government bond yields were on the rise again, although there was some difference, with the UK and Australia underperforming due to higher-than-expected inflation and a greater resolve by central banks to combat inflation. The majority of major central banks kept raising interest rates over the quarter. However, the Fed was the first to pause in June, leaving rates at 5% to 5.25% after more than a year of consecutive rate increases.

Longer Term

The following charts show the performance of Global Markets, Global Factors and Defensive Assets over the last 1,3 and 5 years. Whilst returns are positive over 3 and 5 years across all growth assets, there is some variance. This is to be expected and why we adopt various asset classes and regions in our portfolios to provide a high degree of diversification within the portfolios.

In relation to defensive assets, we would not expect to see large gains in these asset classes as their role in our portfolios it is to provide a “cushion” during market volatility as opposed to capital growth. We adopt a global approach to avoid any over reliance on one countries bonds, as we can see the difference between global bonds and their UK equivalents.

Potential Risks to portfolios

As many know, we don’t believe in crystal balls, nobody knows what is going to happen tomorrow. However, what we have looked at is how our portfolios are structured to deal with some of the conditions we are faced with today, and if they got worse.

We have considered the threat, followed by the key risk posed by the threat and the key mitigation within our portfolios.

Although the UK’s inflation rate is expected to fall steeply to around 5% towards the back end of the year, there are obviously risks to this forecast. This could impact on yields and thus bond prices if inflation remains stubbornly high. Our key mitigation of this is continuing with our sensible portfolio structures, where growth assets provide long-term protection from inflation.

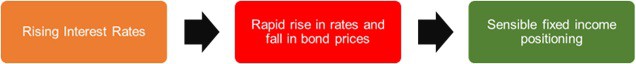

Another key risk is rising interest rates, as forecasting where they go from here is difficult, but higher than expected or prolonged inflation could provide further upward pressure on rates and result in falls in bond prices. The key mitigation of Portfoliosense® is to continue to adopt a sensible fixed income positioning, which hold short duration exposure which limits this impact on portfolios.

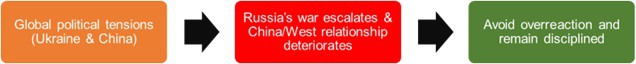

We continue to see the terrible conflict unfold in the Ukraine, coupled with a downward spiral in the West’s relationship with China Unfortunately there is still room for some global political tensions to either continue to increase. The key mitigation here is to avoid overreaction and remain disciplined. Well diversified strategies like Portfoliosense® will mitigate shorter term market uncertainty and high-quality bonds should support portfolio valuations during volatile periods.

Finally, rising bond yields, global recession and the escalation of war in Ukraine could undermine markets and there is room for downside surprises. Markets have been relatively resilient despite the geopolitics seen so far, but we could still see global market declines. To protect our portfolios against this, maintaining a highly diversified portfolio not overly reliant on one economy, region or style is a key defence, whilst again the high-quality-shorter dated bond should help protect if/when market falls occur.

In conclusion, markets will continue to react to events across the world, the best thing to do from an investment perspective is to remain resilient and not react. The evidence supports that returns will be generated over the long term, we just don’t know when they will come, but the best place to be when they do come is being invested.

Investment Risk Warnings

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk which may differ significantly.

If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice. Tax rules may change in the future and taxation will depend on your personal circumstances. Charges may be subject to change in the future.

For each of the portfolios we recommend we are able to demonstrate, using back tested simulated data, the historic returns, the anticipated future returns (allowing for inflation) and the historic downsides (including the worst-case scenario that would have been experienced had you been invested throughout the data period), over a variety of time periods.