On 22 November 2023, the chancellor of the exchequer, Jeremy Hunt, delivered the autumn statement to the House of Commons.

One of the areas which grabbed the headlines was the reduction in Class 1 National Insurance contributions from 6 January 2024. As this change is in place now, we have taken a look at what this actually means for individuals, but also considered the bigger picture.

Class 1 National Insurance Contributions (NIC) are made on earnings received by anyone between the age of 16 and state pension age who is getting more than £242 a week from one job. You have to pay them, and they are automatically deducted by your employer.

From 6 January 2024, employees will pay 10% on earnings between £242 and £967 a week, reduced from 12%, whilst paying 2% on all earnings above £967 a week (£50,284 a year).

The Treasury said this is “the largest ever cut to national insurance” and that 27 million workers will benefit. It stated that an average employee on a salary of £35,400 will benefit by £450 a year, whilst an average full-time nurse on £38,900 will benefit by more than £520.

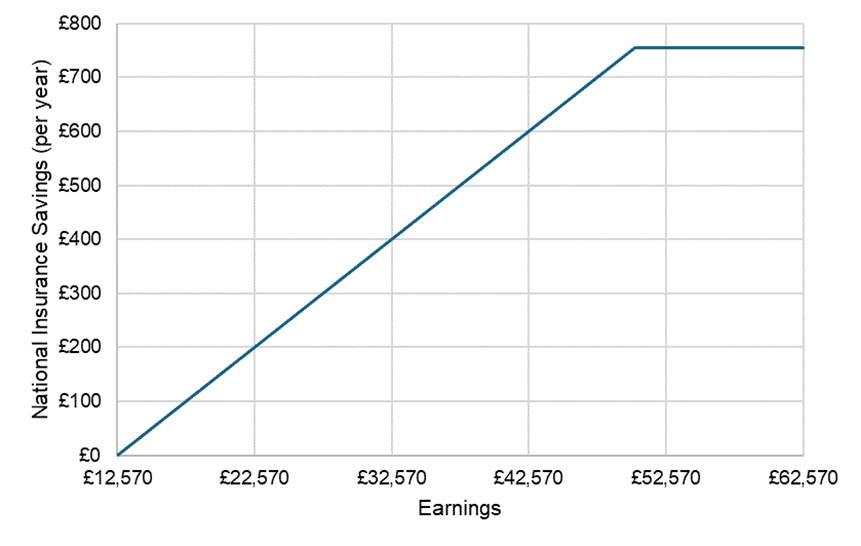

Effectively, the benefit will be capped at £754 a year, and for those earning below £50,270, the actual benefit will be on a sliding scale as demonstrated in the below chart:

Whilst the above is for employees, the Autumn budget also announced changes for people who are self-employed.

If you are self-employed and your profits are £12,570 or more a year, you usually pay “class 2” and “class 4” NICs.

From 6 April 2024, the government is reducing the main rate of class 4 self-employed NICs, paid on profits between £12,570 and £50,270, from 9% to 8%. It is also abolishing class 2 self-employed NICs. These are now £3.45 a week.

Taken together, these changes will result in an average self-employed person on £28,200 a year saving £350 in the 2024/25 tax year, says the Treasury. A typical self-employed plumber on £34,400 will be £410 better off as a result of these cuts, it adds.

In isolation, the above looks like a positive position as many people will effectively have more money in their bank account after allowing for various taxes as a result of these changes.

However, we need to consider the full picture to really understand the benefits when compared to income tax treatment.

Something which did not make the headlines as much, was the continuation of freezing personal income tax thresholds, as previously announced by the government.

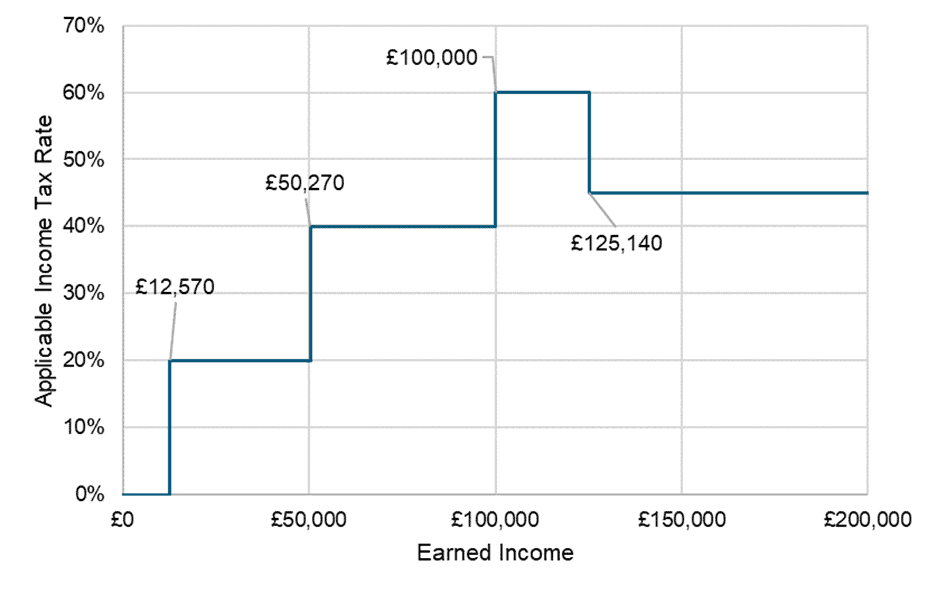

Currently the effective level of income tax people incurs based on their earnings is as follows:

Note: Whilst a tax charge of 60% does not technically exist, given the tapering of the personal allowance for those who earn between £100,000 and £125,140, an effective tax charge of 60% would be applicable.

The last time these thresholds increase was April 2021. Since then, inflation (as measured by UK Consumer Price Index) has risen by almost 20% (source: FE Analytics). If this increase was applied to the current thresholds, then the Personal Allowance could have been approximately £15,000 (up from £12,570) and the level people would start to pay higher rate tax could have been approximately £60,300 (up from £50,270).

Hopefully to offset the increase in costs of goods, but also reflecting their own personal and company performance, many employees will have received pay rises. Therefore, lets consider a case study to assess the impact of the freezing of the income tax threshold could have:

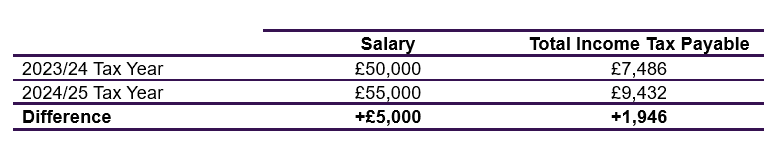

Mrs Smith earned £50,000 in the 2023/24 tax year and she received a pay rise to £55,000 for the 2024/25 tax year. The following is approximately the level of tax she would expect to pay and the difference to the 2023/24 tax year:

With the reduction in Class 1 NICs, Mrs Smith would benefit from a reduction of £754, but this does not offset the increase in income tax she would pay.

Naturally, the more you earn the more tax you can expect to pay, but the freezing of the thresholds rather than increasing in line with inflation will contribute to the overall tax Mrs Smith is likely to pay.

It is not all doom and gloom, Mrs Smith at least does benefit from the reduction in Class 1 NICs, whilst there are some strategies people could utilise to reduce their tax position, including but not limited to:

- Where possible, structure income payments in order to utilise all available allowances, for example receiving income as dividends.

- Make a pension contribution and receive tax-relief at your marginal rate.

Of course, the suitability of any potential strategy will be depending on your personal circumstances and financial position. Therefore, it is always important to seek financial advice before considering the best course of action.

Risk Warning

This article is distributed for educational purposes only and should not be considered as advice. This article does not represent a recommendation of any strategy or approach in relation to pension planning.