The Great British Public has long had a love affair with bricks and mortar, witness the continued (if waning) popularity of buy-to-let, despite all the tax obstacles being thrown at it (with more to arrive in April). It set us wondering what the last decade revealed about the returns from UK residential property compared to UK shares.

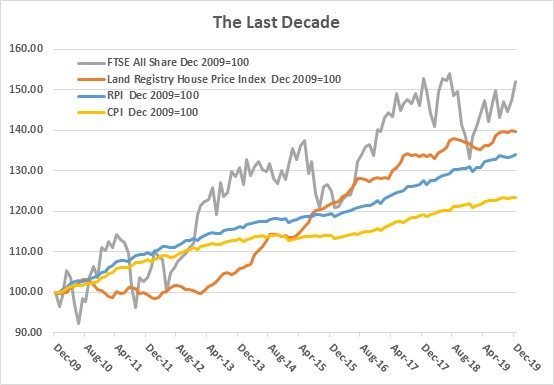

The graph above is a limited attempt to do just that, looking also at inflation, as measured by the RPI and CPI:

- It rebases everything to 100 at December 2009 for consistency.

- It uses the Land Registry index of house prices, which only runs to November 2019 – December’s figures will be issued in about a fortnight. The Land Registry numbers include more underlying data than the Nationwide or Halifax indexes as cash purchases are covered. Interestingly, the Nationwide figure for the decade shows house price growth of 33% against about 40% for the Land Registry. At 33%, the Nationwide Index very marginally underperformed the RPI over the ten years.

- The more comprehensive FTSE All-Share has been used to show UK equity market performance rather than the FTSE 100; the FTSE 100 posted a gain of 39.9% over the decade, against 52.0% for the FTSE All-Share which reflects the strong performance over the period of the FTSE 250 mid-cap shares (in the tier below the FTSE 100) – up 135.1%.

- The gap between the RPI (blue line) and CPI (yellow line) is a 0.84% a year difference, whilst there is consultation to reform RPI, any changes will not be introduced until 2025 at the earliest.

- Within FTSE All-Share and House Price data, income is not included as there is little actual rental data available. Clearly, income generation should not be ignored; for the FTSE All-Share, reinvesting dividend income would have produced a total return of 114.6% (7.94% a year).

COMMENT

Past performance is not a guide to the future, as every financial ad reminds us. However, it can be a useful reminder of the past. How many people remember that house prices spent much of the first half of the decade growing at a slower pace than inflation..?