For anyone who owns a Buy to Let or second property, there are several important tax and legislative changes that come into effect this April.

From changes in the way mortgage interest is claimed, to a new timescale for paying Capital Gains Tax, here is everything you need to know.

Mortgage interest tax relief changes

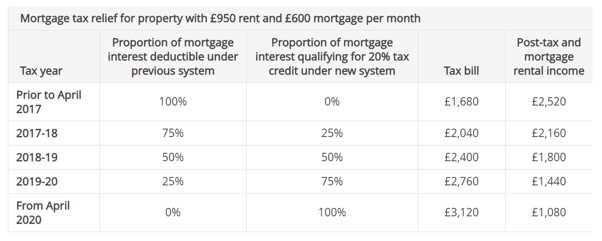

In 2015, the former Chancellor, George Osborne, announced that the way in which landlords were able to claim mortgage interest tax relief would change.

These changes have been gradually phased in over the last four years and the final change comes into effect in April 2020.

Previously, landlords were able to deduct the total cost of mortgage interest from their rental income, in addition to other expenses such as maintenance and letting agent’s fees.

However, since April 2017, tax relief for the cost of mortgage interest has been gradually restricted to a basic rate tax credit. This comes into force this April.

Source: Which?

Source: Which?

In the 2020/21 tax year, landlords will no longer be able to claim any tax relief on mortgage interest payments. Instead, from this April, they will receive a 20% tax credit on interest payments.

If you’re a higher or additional-rate taxpayer, you will be worse off as the credit only refunds tax at the basic 20% rate.

You could also be forced into a higher tax bracket because you will have to declare the total rental income on your tax return. This could push your total income into the higher or additional-rate tax brackets, depending on your income from other sources.

Private Residence Relief (PRR)

Private Residence Relief (PRR) is a useful Capital Gains Tax (CGT) exemption. It comes into effect if you have occupied a property as your main residence at some stage, before later giving up occupation.

The relief is designed to give individuals a CGT-free period in which to sell a property, once they have moved out.

At present, a landlord can claim PRR for:

- All the time they lived in the property

- An additional 18 months after moving out

From April 2020, a landlord will only be able to claim PRR for:

- All the time they lived in the property

- An additional nine months after moving out

Note that special rules giving those with a disability, and those in care, a final period exemption of 36 months will still apply.

The government’s view is that nine months is an appropriate length of time to sell a property, while not being long enough to allow large amounts of tax relief to accrue on two properties.

If you’re thinking of buying a new residential property before you have sold your existing home, you could be affected by this relief. If it takes you more than nine months to sell your existing home, you will lose part of the relief you would previously have been able to claim.

Lettings Relief

In the past, Lettings Relief has been available to an individual who sells a property which has been their main residence at some time during their period of ownership.

This has become more common in recent years as people have bought a property, lived in it as their main residence, and subsequently moved out and let it out. Sometimes this is by choice, while other times so-called ‘reluctant landlords’ have let out a property as they have had difficulty in selling.

Historically, the amount of relief available has been limited to the lower of:

- £40,000

- The amount of private residence relief that the individual is entitled to

- The amount of the gain calculated to have arisen during the letting periods.

Changes to Lettings Relief that come into force in April 2020 mean that the relief will only be available where a homeowner and a tenant have occupied the property at the same time (shared occupation).

The change means that people who have let properties after they moved out will lose the relief that they would have been entitled to for those letting periods.

For a basic rate taxpayer, who pays tax on residential property disposals at a rate of 18%, the relief on £40,000 of gains is worth £7,200.

A higher rate taxpayer who pays tax at 28% on such disposals could see their tax bill increase overnight by £11,200.

Changes in the timescale for paying Capital Gains Tax

From 6 April 2020, new regulations will change the way in which Capital Gains Tax is paid on the disposal of UK property.

The new rules mean all UK residents who have CGT to pay when they sell, gift or otherwise dispose of any UK residential property will have to calculate, report and pay that tax within 30 days of the completion of the sale.

This is important because, changes to the reliefs above mean that you could not only have a larger amount of tax to pay but also have to pay that tax within 30 days of completion.

- A sale made on 5 April 2020 – tax payable 31 January 2021

- A sale made on 6 April 2020 – tax payable 31 May 2020