A good proportion of people shy away at the mention of the word ‘maths’; but in the investing world there are some quirky mathematical outcomes that are worth reminding ourselves of. The first is that if an investment goes up 100%, it only has to go down 50% to get back to where it started. The second is that if an investment goes down 50% it has to go back up 100% to get back to where it started. To some that may be obvious, but to others less so.

The past two years have given us quite a few live examples of this maths in action, and potentially most notably was Cathy Woods’ ARKK Innovative Technology fund. This fund posted a stellar return of around 190% from the start of 2020 to February 2021 and she quickly became the darling of the US financial TV shows. The ARKK Innovative Technology fund is actively managed and targets specific technology sectors which leads to a highly concentrated fund.

If we compare that to the Vanguard LifeStrategy 100% Equity fund, which invests entirely across global equities but has a similar investment approach to those we adopt at Henwood Court, this fund produced a return of just over 10% over the same period.

On the surface, an investor may feel a bit disappointed by the performance comparison, however a return in the region of 10% over the period is a good outcome, given that in Quarter 1 of 2020 the markets fell substantially on the back of the pandemic.

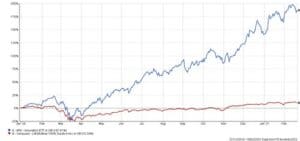

The following graph highlights the performance of the two funds to ARKKs over this period:

Source: FE Analytics

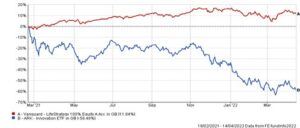

If we roll on from 19 February 2021 to 14 April 2022, we can see the maths in relation to percentage returns in action as ARKK has lost just under 60% as highlighted in the following chart:

Source: FE Analytics

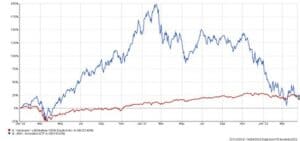

If we combine these two periods together, we can see that ARKK has posted a cumulative return of just over 19% despite the initial rise of almost 200%:

Source: FE Analytics

Over the whole period, ARKK is up just over 19% and the Vanguard LifeStrategy 100% Equity fund is up just over 23%, so not much to choose between the two; or is there?

There are two sides to the investment coin. One is return and the other is risk. Over the whole period, the ARKK fund is almost three times more volatile than the Vanguard LifeStrategy 100% Equity fund, which makes it inherently harder to live with.

The other useful lesson to take from this example is that most of the stellar performance occurred when the ARKK fund was relatively small. The 200% performance quoted above assumes an investment was made on 1 January 2020 and held for the period under review.

Yet the fund only became popular once the bulk of the rise had already happened. A large component of investor’s money was invested at, or near ‘peak’ ARKK and has suffered the bulk of the subsequent fall. Morningstar, a reputable, independent fund research house, has estimated that in the three years to 31 December 2021, the total return (relating to a lump sum invested at the start of the period, otherwise known as a time-weighted return) was around 35% per annum (in USD terms).

On the other hand, if fund flows are accounted for, the average investor generated a return somewhere in the region of 10% p.a. (known as the investor, or money-weighted, return). This 25% or so annual difference is sometimes referred to as the ‘behaviour gap’.

Sometimes, investors can feel left behind, but the diversified nature of their portfolio across markets, sectors, companies and other asset classes such as bonds, results in a much smoother journey to their destination. The highs may not be so high, but the lows take less recovering from, reigning in the ‘flavour of the month’ investor. This encourages investors to stay invested and allows them to cope with the emotional and behavioural feelings investments bring.

The maths of percentages in investment returns may be quirky, but it is important.

Investment Risk Warnings

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk which may differ significantly.

If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice. Tax rules may change in the future and taxation will depend on your personal circumstances. Charges may be subject to change in the future.