Our priority as your financial adviser is to make sure your investments are strong and focused on your long-term goals. While we don’t change the underlying investments in your portfolio all the time—and it might sometimes feel like nothing is happening—there is actually a lot of work going on behind the scenes.

Behind the Scenes: Our Investment Committee

Our Investment Committee (IC) is always busy researching, reviewing, and questioning our investment strategy. We only make changes when we are confident they will genuinely improve your portfolio, not just for the sake of looking busy. This disciplined oversight is how we keep your portfolio in the best possible shape.

A key role of our Investment Committee is ensuring that the investment options we recommend to you are ‘best in class’. This requires us to run a comprehensive due diligence and product screening program every year to identify and maintain only the highest quality investment options.

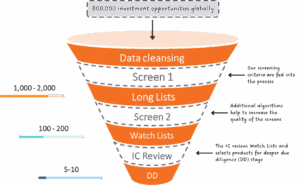

The process is extremely thorough: we analyse about 800,000 investment opportunities, screen hundreds of data points, and review tens of millions of unique pieces of data to get the job done properly. Essentially, our commitment to you is consistent, diligent monitoring—even when our investment recommendations remain unchanged.

The graphic and subsequent points below are a whistle stop tour of how our screening process works, step by step.

Figure 1: Our product screening process

Source: Albion Strategic Consulting.

Data cleansing

Before we begin to assess investment options, we make sure the data we use is accurate and complete. This involves checking and combining information from multiple sources, removing errors, and filling gaps where possible. If data are missing or unclear, we’ll seek out alternative sources, run calculations internally, or contact the provider directly to ensure we have the right information.

Screen 1

We start with a wide net – hundreds of thousands of investment products. Our first screen applies basic criteria, such as whether a product is available for sale locally or meets a minimum track record and scale. We measure how well index funds track their stated benchmarks – for example – as well as identifying the appropriate geographic exposure. This helps us quickly narrow down the options to those that are relevant and suitable for our clients. We review our criteria annually to ensure that they are still sensible.

Long Lists

After the initial screen, we arrive at “Long Lists” for each investment asset class (such as developed equity, emerging equity or short-dated bonds). These lists include all products that pass our agreed criteria, and we keep a record of why each was removed at this stage or progressed as appropriate.

Screen 2

Next, we apply a more detailed analysis to the Long Lists. This might involve comparing products on factors like all-in cost, investment styles, available to retail investors, product type and data transparency and removing those that don’t measure up. For example, if a fund is much more expensive than similar available options or lacks key data hindering our ability to assess its structure, it won’t make it through this stage. Transparency is a key consideration in our investment approach.

Watch Lists

The result is a “Watch List”. These include the very best potential products within each investment category. These are the products we consider the most suitable options for inclusion in client portfolios. We review these lists at the IC level, firstly to check that the products we recommend meet these standards. If not, this leads to a further investigation. Secondly, to explore whether any alternative products on the list may offer a superior solution for our clients moving forward.

Investment Committee (IC) review and due diligence

Our IC conducts further due diligence and analysis on any product that looks like a candidate, including both internal and third-party analysis, as well as materials directly from the product provider. Decisions either to stick as we are or change are signed off at the IC meetings.

Little details matter because investment landscapes change – what made for an evidence-based portfolio twenty years ago looks different to today. By paying close attention through time, we position your portfolio to be in the right place for the next twenty years and beyond without cutting corners. We’ll always communicate any changes to you clearly and explain the reasons behind them.

There’s a way to do it better – find it.

Thomas Edison to his staff (allegedly)

General Investment Risk Warnings

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk which may differ significantly.

If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice. Tax rules may change in the future and taxation will depend on your personal circumstances. Charges may be subject to change in the future.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated. Portfolio performance data are for illustrative, educational purposes only and do not represent live client portfolios.