Following the Spring Budget on 15 March 2023, the Government has published the Spring Finance Bill 2023, effectively delivering a number of the pension tax changes announced.

In particular, the bill includes pension tax changes designed to support doctors and other individuals to stay in work, however the reality is the changes will impact a wider audience then those targeted.

The changes announced included:

• Abolishing the Lifetime Allowance and the associated tax charges.

• Increasing the Annual Allowance and levels tapering are applied.

• Increasing the Money Purchase Annual Allowance.

Based on these changes, the Office for Budget Responsibility estimated that around 15,000 individuals will remain in the labour market as a result of the changes to the Lifetime Allowance and Annual Allowance in particular, many of whom are expected to be highly-skilled workers, including senior doctors.

The introduction of these changes is going to result in people reviewing and reconsidering their pension planning. The following is a couple of common scenarios and our take on the implications of the pension changes being introduced.

I have Fixed Protection, should I start pension contributions and lose the protection as the Lifetime Allowance is being abolished?

For those who hold Fixed Protection, it is important to consider what the protection provides you with.

Fixed Protection secured an individual a fixed lifetime allowance (normally above what the available standard lifetime allowance was), and subsequent tax-free cash entitlement, at a set level depending on what version the member holds.

There are three different levels of fixed protection available:

One of the conditions of applying for Fixed Protection was that if individuals started to build up addition pension funds by joining a new scheme or making pension contributions, the Fixed Protection would be lost.

Due to this, many people who applied for Fixed Protection would have ceased pension contributions to maintain their access to a higher Lifetime Allowance, either to avoid any potential Lifetime Allowance charge entirely or reduce any potential charge in the future.

Due to the removal of the Lifetime Allowance charge in the 2023/24 tax year, and the abolishment of the Lifetime Allowance altogether in the 2024/25 tax year, it could be viewed that maintaining any level of Fixed Protection is now void, which from this point it is. However, what about the tax-free cash entitlement?

With the Lifetime Allowance being abolished in the 2024/25 tax year, the government has capped future tax-free cash entitlements at 25% of pension funds subject to a maximum of £268,275. One downside to this approach, is that future inflation will effectively erode the value of the tax-free cash entitlement.

HMRC have confirmed that people who effectively break their Fixed Protection (for those who held the Protection before 15 March 2023) by building up additional pension benefits will still maintain their higher protected Lifetime Allowance value of the purposes of the 25% tax-free lump sum.

Therefore, based on the legislation released, if those who hold any form of Fixed Protection and have the ability to build up additional pension benefits would not be penalised by doing so.

My pension fund is currently above the Lifetime Allowance, should I crystalise my pension fund entirely in the new tax year to benefit from the LTA charge being waived?

At a high level it would look as though the answer is yes. The waiving of any potential Lifetime Allowance tax charge for the 2023/24 tax year means there would be no financial penalty in doing so.

The following looks at the Lifetime Allowance tax charge position if fully crystallising a £1,400,000 pension fund in the 2022/23 tax year compared to 2023/24 tax year:

In this scenario, the individual would still retain their full pension value due to the removal of the tax charge by fully crystallising the pension funds in the 2023/24 tax year. Therefore, it would appear sensible to do so.

However, given the Lifetime Allowance is being abolished in the 2024/25 tax year, there is no rush to crystallise funds, as the situation would be the same for future tax years.

Therefore it is important to consider your individual circumstances!

By crystallising funds you also release tax-free cash. Whilst this might seem like a good idea, it is important to consider the overall impact of receiving these funds, if you have no actual need for them, particularly the potential Inheritance Tax implications.

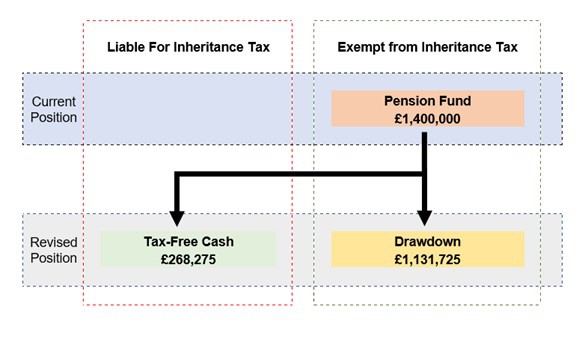

Using the same scenario as above, the Inheritance Tax implications are as follows:

Whilst funds are held in the pension environment, the full value is currently exempt from Inheritance Tax. This is potentially a reason why those who currently hold Fixed Protection as covered in the question above, could consider starting further pension contributions moving forward.

When tax-free cash is released, these funds effectively enter your estate with the funds placed into Drawdown remaining exempt from Inheritance Tax.

As always, it is important to consider your individual circumstances before crystallising your pension. In the above scenario, if you have no need for £268,275, then you could potentially be exposing these funds to Inheritance Tax and a potential tax charge of 40% (depending on your Inheritance Tax position). Remember, the action was only being taken due to the removal of the Lifetime Allowance tax charge.

However, should you have the requirements for £268,275, for instance large one-off purchases, gifting funds, establishing a trust to name a few, then the above course of action could be suitable.

One benefit of accessing the tax-free cash entitlement sooner rather than later, is that it limits the impact inflation (effectively retains the purchasing power) has on the future value of the tax-free cash entitlement.

It is worth remembering that the drawing of funds from Drawdown are currently, and will remain, subject to income tax, unfortunately nothing has changed on this!

There is some caution on all of this.

The opposition party have already stated they would look to reintroduce the Lifetime Allowance should they get elected at the next general election. The impact this could have on the above scenario is the funds which are held in Drawdown. Currently, when an individual reaches age 75, any growth on any funds in Drawdown is tested against the individuals Lifetime Allowance.

Should the Lifetime Allowance be reintroduced in the future, there could be a scenario where this test is measured again, and individuals are faced with a future lifetime allowance charge on funds held in Drawdown solely because they wished to crystallise funds when the Lifetime Allowance was abolished. Also, what if the opposition party reinstated the Lifetime Allowance, but this was at a higher level than currently applicable, which in turn could mean those who crystallise benefits now, could receive a lower level of tax-free cash entitlement. There are a lot of what if’s, which make this a complex area.

As with all financial decisions, it is important to consider the impact of taking a course of action. We would be able to consider the above action as part of your Financial Plan and ensure you are in an informed position before taking action.

I have previously had the maximum I can contribute to a pension each year limited, is there any change in relation to this?

Firstly, the budget included an announcement that the Annual Allowance (the maximum amount of pension savings an individual can make each tax year without incurring a tax charge) will increase from £40,000 to £60,000 from the 2023/24 tax year.

This increase alone provides individuals with the potential to receive up to an extra £4,000 of basic rate tax relief if they are able to contribute the full £60,000.

However, from the 2023/24 tax year, anybody who has taxable income over £260,000 (increased from £240,000 for previous tax years) per annum could have their annual allowance reduced by £1 for every £2 they earn over the £260,000. The maximum reduction would be £30,000, resulting in an annual allowance of £10,000.

Therefore, depending on the level of income and other factors (personal and employer pension contributions), people who have previously had their annual allowance limited should benefit from an increased annual allowance, and subsequently have the potential to benefit from increased tax relief, due to the recent budget.

The following table highlights the changes based on a range of income figures:

| Annual Income | 2022/23 Annual Allowance | 2023/24 Annual Allowance | Change | Additional Tax Relief |

| £60,000 | £40,000 | £60,000 | £20,000 | £4,000 |

| £100,000 | £40,000 | £60,000 | £20,000 | £4,000 |

| £200,000 | £40,000 | £60,000 | £20,000 | £4,000 |

| £260,000 | £30,000 | £60,000 | £30,000 | £6,000 |

| £312,000 | £4,000 | £34,000 | £30,000 | £6,000 |

| £360,000 | £4,000 | £10,000 | £6,000 | £1,200 |

| £400,000 | £4,000 | £10,000 | £6,000 | £1,200 |

I have heard the Money Purchase Annual Allowance has increased to £10,000, does this impact on me?

When you first access a pension of any kind to draw an income, your available annual allowance for all subsequent tax year years is automatically reduced to the Money Purchase Annual Allowance regardless of your income level.

From the 6 April 2023, the Money Purchase Annual Allowance will be increased from £4,000 to £10,000. Therefore, if you are subject the Money Purchase Annual Allowance, from 6 April 2023 you would be able to contribute an additional £6,000 to a pension arrangement, which would result in you receiving an additional £1,200 in basic rate tax relief.

As always, affordability and expected outgoings should be considered when investing any further funds.

Conclusion

All the above is based on our understanding of the budget and is based on the current legislation.

Unfortunately, politics is ever changing, and as noted above, the opposition party have already stated it would be their intention to re-introduce the Lifetime Allowance should they be elected. It feels very much like pension regulations and tax are being used as a political football. Pensions should be about planning for the long-term and your retirement, not scoring a point (or goal) on the opposition party.

That said, we can only plan on what we know and what legislation is in place. Therefore, on the surface the changes announced in the budget are beneficial to many people however careful consideration and planning needs to be considered before any changes are made to your pension planning. As always, we are here to help, so should you wish to discuss anything covered in this article or any other financial planning matter, please do not hesitate to contact your Financial Planner.