The third quarter of 2023 was a challenging one for markets and asset classes across the globe. Inflation and interest rates are still on the tip of many market commentators’ tongues, but we have also seen yet more conflict unfold with the horrific events in Gaza coupled with the ongoing Ukraine conflict. If you missed our article regarding Gaza, this can be found here.

The following provides an overview of what has been happening over the last quarter.

Supported by its abundance of oil majors (e.g. BP, Shell), the UK market finished the quarter in positive territory. This was largely supported by the Energy sector which was by far the best-performing sector. After a weak second quarter for Energy stocks, a rebound materialised as these companies benefited from higher oil prices, largely driven by leading global oil producers Saudi Arabia and Russia having both committed to cutting production and drawing down global supply. Consumer confidence also grew throughout the quarter amid hopes that the base interest rate had peaked, following the Monetary Policy Committee majority vote to pause the rate hiking campaign and hold rates at 5.25% in September.

In the US, investors were optimistic at the start of the quarter that the era of policy tightening rates would soon end, however, this enthusiasm withered over the quarter. The US labour market remains strong, however, according to the Bureau of Labor Statistics the unemployment rate rose by 0.3% in August. Most of the so called “Magnificent Seven” – Apple, Microsoft, Alphabet, Amazon, Tesla, Nvidia and Meta – declined, weighing on the overall market return.

Europe saw a fall in quarter 3 as worries continued to grow over the negative effects of interest rate rises on economic growth. However, these worries didn’t appear to match the inflation figures released right at the end of the quarter which showed inflation had slowed to a two-year low. Once again, the energy sector supported the region.

The Japanese market demonstrated resilience during the quarter. Large growth stocks were impacted by rising interest rates and bond yields in the US and Japan, however, smaller stocks held up well and value stocks experienced a surge. As a result, the Japanese market generated a positive return for the quarter.

In the rest of Asia, a smaller fall was recorded, as concerns over the Chinese economy and fears over global economic growth weakened investor sentiment. Hong Kong, Taiwan and South Korea were the weakest markets, whilst Malaysia and India achieved growth over the quarter.

A small positive return was generated in the Emerging Markets in sterling terms. Across the asset class, the concerns that strength in the US economy will keep interest rates higher for longer had a negative impact on risk appetite. This was combined with ongoing weakness in the Chinese economy and concerns about the property sector. Poland, due to political uncertainty, and Chile, being hurt by falling lithium prices, saw the biggest falls in the quarter. Egypt and Turkey saw the best returns in the asset class. In the latter, two rate rises in the quarter were viewed as a sign the central bank was potentially becoming more orthodox in its policy approach, which supported sentiment.

When we start to expand the timeframe of each asset class out, we start to see stronger returns and the benefits of diversification as returns vary across different asset classes and periods.

| 12 Months | 3 Years | 5 Years | |

| Global Markets | 9.9% | 34.8% | 53.0% |

| UK | 13.8% | 38.9% | 18.7% |

| US | 8.5% | 41.5% | 69.1% |

| Europe (ex-UK) | 20.0% | 26.8% | 35.2% |

| Japan | 14.3% | 14.9% | 18.7% |

| Asia (ex-Japan) | 5.0% | 16.4% | 16.4% |

| Emerging Markets | 1.8% | -0.5% | 8.8% |

To end of September 2023

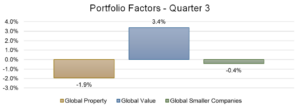

Global Value emerged the quarter as the best factor. During a period marked by inflation and increasing interest rates, present earnings tend to gain greater significance while future earnings lose some of their value. Typically, value stocks are evaluated based on their current earnings, whereas growth stocks are priced with an eye on their future earnings potential. As a result, this prolonged period of elevated inflation has been advantageous for value stocks.

Global Smaller Companies and Global Property recorded a loss for the quarter. Higher rates across the globe have provided significant hurdles for smaller companies with less robust financial positions, unlike their larger counterparts with more substantial financial resources and “deeper pockets”. Whilst Global Property recorded a decline over the quarter, the evidence continues to support the diversification benefits offered by the asset class and why it is included in the portfolios. It is important to remember that Global Property is more than just office, retail parks and warehouses, it also includes residential, hotels, and healthcare facilities to name a few.

When looked at over the longer timeframes below, it continues to show the key diversification benefit offered by the asset class/factors.

| 12 Months | 3 Years | 5 Years | |

| Global Property | -7.0% | 8.0% | 2.1% |

| Global Value | 12.6% | 55.0% | 32.8% |

| Global Smaller Companies | 4.4% | 27.0% | 24.1% |

To end of September 2023

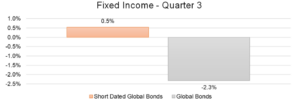

Central banks worldwide have spent over a year raising interest rates to try and combat inflation, reaching levels not witnessed since the late 2000s. Despite the bullish sentiment fuelled by a narrow tech rally during the first half of the year, it became evident that some of this optimism was misplaced, especially regarding expectations that the Federal Reserve would soon shift towards reducing rates. Instead, “higher for longer” has emerged as the latest catchphrase on Wall Street.

During both August and September, the Federal Reserve upheld its funds rate target, maintaining the status quo after a quarter-point hike in July. In similar fashion, the Bank of England raised the base rate to 5.25% in August, but signs of slowing inflation allowed them to keep rates steady in September, which helped gilts remain relatively stable for the quarter.

Even though fixed-income markets are now offering their most attractive yields in over 15 years, longer-term bonds have seen much greater falls in value (explained by the inverse relationship between bond prices and yields), unlike their shorter-term counterparts, which generated positive returns for the quarter. This is marginally highlighted by the returns seen across Short Dated Global Bonds and those with a slightly longer-term approach.

The extended timeframes are heavily influenced by the continued interest rate hikes seen during 2022, and the “declines” seen in the longer dated segments of the bond markets. These declines are one of the reasons we adopt a short dated, high credit quality approach to our defensive elements of the portfolios, as these are the characteristics which should provide the “cushioning” during periods of market volatility.

| 12 Months | 3 Years | 5 Years | |

| Short Dated Global Bonds | 2.4% | -4.6% | 1.2% |

| Global Bonds | 0.6% | -15.1% | -4.2% |

To end of September 2023

In our last article, we looked at some of the potential risks to the portfolios and how the portfolios are structured to mitigate these risks.

Having reviewed these, the position remains broadly similar to the last review, therefore, should you wish to recap on these, then please see the previous article which can be found here.

In summary, markets will always react to events across the world, the best thing from an investment perspective is to remain resilient and not react, try and blank out the “noise”. The evidence supports that returns will be generated over the long term, we just don’t know when they will come, but the best place to be when they do come is to be invested.

Investment Risk Warnings

Please remember the value of your investments and any income from them can go down as well as up and you may get back less than the amount you originally invested. All investments carry an element of risk which may differ significantly.

If you are unsure as to the suitability of any particular investment or product, you should seek professional financial advice. Tax rules may change in the future and taxation will depend on your personal circumstances. Charges may be subject to change in the future.

For each of the portfolios we recommend we are able to demonstrate, using back tested simulated data, the historic returns, the anticipated future returns (allowing for inflation) and the historic downsides (including the worst-case scenario that would have been experienced had you been invested throughout the data period), over a variety of time periods.

Returns based on the following funds which replicate the relevant asset class:

- Dimensional Global Value

- Fidelity Index Europe ex UK

- Fidelity Index Japan

- Fidelity Index US

- Fidelity Index World

- iShares Environment & Low Carbon Tilt Real Estate Index

- Vanguard Emerging Markets Stock Index

- Vanguard FTSE Developed Asia Pacific ex Japan UCITS ETF

- Vanguard FTSE U.K. All Share Index

- Vanguard Global Bond Index Institutional Plus Hedged

- Vanguard Global Short-Term Bond Index Institutional Plus Hedged

- Vanguard Global Small-Cap Index Institutional Plus Acc